This is a question that many prospective borrowers ask themselves, once they have made the tentative decision to obtain a reverse mortgage: should they work directly with a lender or go through a borrower?

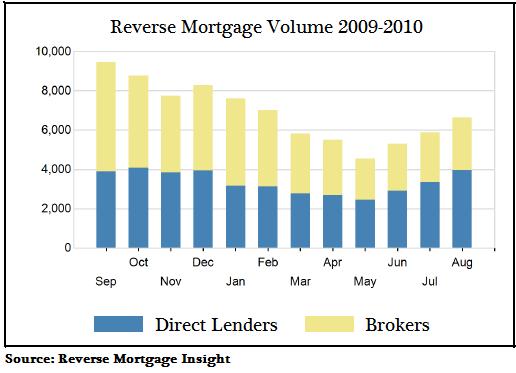

Based on the most recent data, more borrowers are choosing to engage directly with lenders. In August 2010, 60% of reverse mortgages were originated by lenders, compared to only 40% in August in 2009. If you slice the data another way, lenders originated 18% more reverse mortgages – compared to 2009 – while broker loan volume grew by only 6%.

It’s difficult to say for sure what’s driving this trend away from brokers. Their reputation was damaged by the report from the National Consumer Law Center that compared reverse mortgages to subprime mortgages. Brokers were singled out by the report for using unscrupulous practices to enhance their commissions. For example, they have been known to steer reverse mortgage borrowers into inappropriate financial products, such as annuities.

It could also be that changes in reverse mortgage pricing, such as the elimination of origination fees and the service-fee-set-aside (sfsa) and partially subsidized insurance premiums, are making it difficult for brokers to compete, since they can’t offer borrowers such attractive terms. Their lack of competitiveness has been further exacerbated by laws forbidding hidden yield-spread-premiums, which mean that they must earn their commissions directly from the borrower, instead of from the lender.

Since many brokers cannot compete on price, they have taken to selling their expertise and their ability to provide unbiased advice. While there is something to be said for the fact that they don’t have the same financial interest as lenders in originating loans, they still only get paid if elect to obtain a reverse mortgage. In practice, then, they are probably just as biased in lenders when explaining the pros and cons of reverse mortgages.

Finally, given that most lenders offer identical reverse mortgages (that conform to FHA government standards), there probably isn’t much value in advice which purports to help you differentiate one lender from another. In short, the case for using a reverse mortgage broker – as opposed to a direct lender – is looking pretty weak at the moment.

Reverse Mortgages are often billed by lenders as being 100% safe. Since they are insured by the FHA and because they are non-recourse loans, there is no risk of you ever owing the lender money, even if your reverse mortgage is underwater. If you read the fine print, though, you will see that it is still possible to default on your reverse mortgage.

Most reverse mortgages are canceled only when the last remaining borrower passes away or moves out, or when the borrower voluntarily chooses to repay the loan. However, if you fail to pay property taxes and/or fail to maintain the home, you are in violation of the the terms of the loan agreement, and the lender is entitled to cancel the reverse mortgage. This is because a tax lien supersedes the reverse mortgage lien, which means that when the home is sold, the government has priority over the lender in collecting on any debts.

If you are found to be in default, the lender will immediately cut off any unused portion of your line of credit and/or stop remitting monthly payments to you if you elected to receive your reverse mortgage disbursement as term/tenure payments. After giving you a chance to rectify the situation, it may then apply with the local court to foreclosure on your property, and if approved, the property will be sold. Any leftover proceeds from the sale (after the reverse mortgage is repaid and money is set aside for unpaid taxes and maintenance costs) will be distributed to the borrower. Of course, the borrower’s credit will be shattered, and it will be difficult to obtain another loan.

Unfortunately, default is an issue that affects a significant portion of reverse mortgage borrowers – perhaps as many as 30,000. That’s because many borrowers receive the loan proceeds as a lump-sum payment, which is then used to repay debt (such as an existing mortgage) or spent quickly. Such borrowers often fail to set aside enough cash to pay property taxes and maintain the property, and/or are gripped by financial hardship.

In early 2010, the FHA encouraged lenders to foreclose on properties whose reverse mortgages were in default. At the time, the FHA was dealing with financial hardship of its own, and was rumored to be seeking a government bailout. However, it seems that the majority of lenders are still reluctant to foreclose (because of the bad press that it would generate) are awaiting further guidance from the Department of Housing and Urban Development (HUD), which should be released in 2011. There is technically an emergency loan program that is designed to help borrowers whose loans are in default, but only those who are temporarily unemployed are eligible. In short, those that are currently in default can only sit tight and wait.

According to the most recent statistics, 20% of conventional mortgages in the US are now underwater, which means that the loan balance exceeds the value of the home. While comparable figures for reverse mortgages are not available, it stands to reason that a similar proportion of reverse mortgage borrowers are in the same position. Before you start to worry about whether your reverse mortgage is affected by such a condition, there are a few things that you should know.

First of all, all HECM reverse mortgages are no-recourse loans and are insured by the Federal Housing Administration (FHA). That means that if the proceeds from the sale of your home are not enough to repay the balance of the reverse mortgage, your lender is contractually prevented from seeking the difference from you or your estate/heirs. Instead, the FHA will reimburse the lender using funds from the insurance pool. As a result, it is IMPOSSIBLE that you will ever end up owing your lender more than what you borrowed, regardless of what happens to the value of your home in the interim. (Note that this is not necessarily the case with a conventional mortgage).

Second, your lender is permitted neither to alter the terms of the loan nor the size of the loan after the reverse mortgage is originated. If you elected to receive a line-of-credit for $XX or a tenure monthly payment of $XX for the rest of your life, your lender is contractually obligated to honor this commitment for as long as the reverse mortgage remains outstanding (until the borrower passes away, sells the home, or moves out). Even if the value of the home declines to the point that the reverse mortgage is well underwater, the lender is not allowed to cancel or reduce any proceeds that you have yet to receive.

Only if you breach the terms of the contract can the lender freeze the payout of any unclaimed proceeds. That begs the question of whether you should deliberately withdraw any remaining funds in order to guard against such a possibility. For example, if the primary borrower were to pass away tomorrow, the unused portion of any credit line would be immediately frozen. If the home has appreciated in value, then any leftover proceeds will be distributed to the borrower’s estate following the sale of the home. If the home has depreciated significantly, however, then the borrowers’ heirs will receive nothing.

By preemptively withdrawing all unused funds if your reverse mortgage is underwater, you would effectively eliminate this as a possibility. This doesn’t mean that you have to spend this money immediately; rather, you could simply transfer the funds from your reverse mortgage line of credit to a savings account with another bank. The only downside is that these funds will probably accrue interest at a lower rate than your line of credit, which would otherwise grow every year by your reverse mortgage interest rate.

While all of this is bad news for taxpayers (and perhaps future reverse mortgage borrowers), it shouldn’t affect your approach to managing your reverse mortgage. When you initially obtained the loan, its (maximum) size was determined by (among other factors) the appraised value of your home at that time. Regardless of what your home is worth now, or in the future, you are entitled to every cent that the lender promised you and is printed in the loan agreement.

Increased competition, the maturation of the reverse mortgage industry, and its transformation into a commodity product have combined make reverse mortgages less expensive than ever. As a potential borrower, there are a handful of developments that you should be aware of in order to ensure that you get the best deal possible.

First, the Federal Housing Administration (FHA) recently unveiled a new version of its popular Home Equity Conversion Mortgage (HECM) designed to make the reverse mortgage more affordable. Known as the HECM Saver, this option comes without the cost of the upfront insurance premium (a savings of $5000+), but has a lower principal limit. For those that are concerned with value and with smaller cash needs, the HECM Saver represents a good option.

Second, some lenders have begun to pay the FHA insurance premiums on behalf of their borrowers, since they also benefit from the decreased risk. (However, since the annual insurance premium was raised from .5% to 1.25% for all FHA reverse mortgages, it’s unclear if lenders will continue to offer this freebie). In addition, many lenders are eliminating the Service Fee Set Aside (SFSA), in which the $30 Service Fee that must be paid monthly for as long as the reverse mortgage remains outstanding is paid upfront and rolled into the mortgage.

Finally, some lenders have begun to lower their origination fees. As a result, a reverse mortgage today can be obtained for as little as $1,200, plus ~$3000 in other assorted third party closing costs. The result of all of these changes is that if a borrower is lucky, a reverse mortgage won’t cost more than a conventional mortgage. In practice, these savings are usually rolled into the reverse mortgage in order to increase the size of the loan. Still, as a borrower, you can choose to realize these savings as actual savings by simply borrowing the same amount.

It goes without saying that if you want the best deal, you need to speak to multiple lenders. This might sound unnecessary since all offer essentially identical loans with identical interest rates and identical terms. As I explained above, however, some of them might be willing to work a little harder for your business. It doesn’t hurt to ask prospective lenders to match the discounts offered by other lenders.

Remember: the HECM reverse mortgage is a standardized product insured by the FHA, and you would be foolish to pay more for it than you have to.

One of the first questions that someone contemplating a reverse mortgage inevitably asks is, “How much can I get?” Fortunately, you no longer need to speak to a lender in order to obtain an accurate answer. There are several reverse mortgage calculators available for free on the web, which will give you an estimate of how much you can borrow.

The best one that I’ve come across is from the NRMLA; if you’re planning on obtaining a Home Equity Conversion Mortgage (HECM) as 95% of borrowers do, this is the only calculator you need to reference. (If you’re interested in a single-purpose or proprietary reverse mortgage, you will probably have to speak to the state agency or lender, respectively, in order to obtain an accurate estimate, since terms may vary). I found that the NRMLA calculator was the most comprehensive and the most transparent, which is why I’m recommending it here. We also offer a balance remaining reverse mortgage calculator.

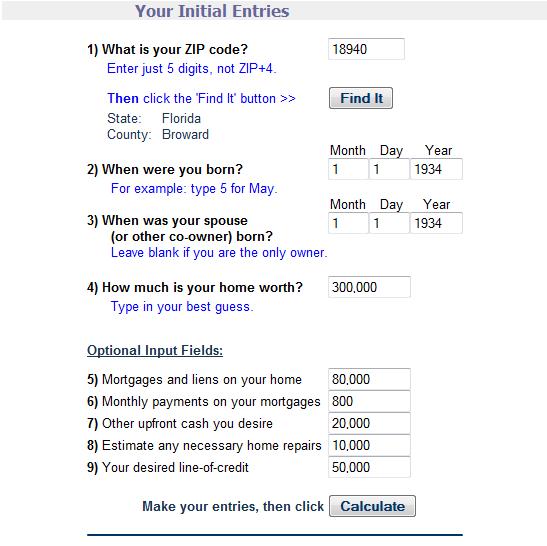

On the reverse mortgage calculator input page, start by entering your zip code (because of regional differences in taxes/fees), and the Date of Birth for you and your spouse. With more than one borrower, the lender will use the younger borrower’s age as a basis for calculating the reverse mortgage, which will yield a smaller loan amount. (You can read an earlier post I wrote to understand your options if there are two primary borrowers). Next, you need to estimate how much your home is worth; try to be precise, since this is the biggest variable in calculating your loan amount. (Before obtaining an actual loan, your home will be formally appraised).

The final set of inputs are optional, and may not apply to your situation. If you have existing mortgage debt/liens, these will need to be paid off upon obtaining the reverse mortgage and subtracted from the principal that you would otherwise be eligible for. The same is true for necessary home repairs; one of the conditions of having a reverse mortgage is that the home must be continuously maintained. Failure to do so could result in your being denied a reverse mortgage initially or a cancellation of the reverse mortgage (and foreclosure of your property) down the road.

The field entitled “Monthly payments on your mortgages” doesn’t actually bear on the reverse mortgage; it is merely included to show you the net change in your monthly cash flow if you elect to receive your reverse mortgage proceeds in the form of a (tenured) monthly payment. “Other upfront cash you desire” will be subtracted from any line of credit. On the flipside, “Your desired line-of-credit” will be subtracted from your available cash if you elect to receive a lump-sum payout.

Now, that you have filled out all of the input fields, click the Calculate button to view the results. Voila!

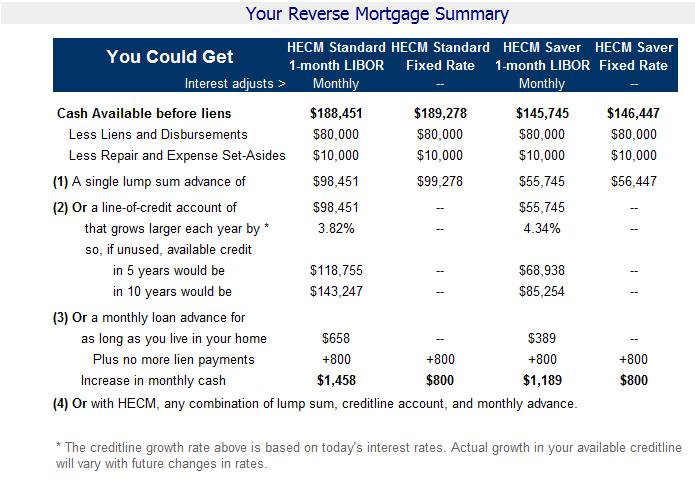

You can see from the Output page (reproduced above) that you actually four separate options when obtaining a reverse mortgage (and several sub-options, which I will explain below). First you must decide between an HECM Standard and HECM Saver. The main difference between these two loan types is that an HECM Standard offers a higher loan amount, and consequently, an upfront insurance premium. (For more on this distinction, you can read an earlier post on the subject). You can see how this is reflected in the calculations. Next, you must decide between a variable rate (which fluctuates over time) or a fixed rate. The downside of choosing a fixed rate HECM is that you must take all of the cash upfront, and cannot elect to receive a monthly payment or line of credit.

Depending on your inputs and certain actuarial assumptions that HUD makes about you as a borrower, “The table below shows the maximum creditline (with no monthly Income), and the maximum monthly income (with no creditline) that may be available after paying off any mortgages and liens against your home,” as well as the maximum lump-sum payment. Notice how these values differ depending on whether you opted for an HECM Standard or HECM Saver. In addition, your (hypothetical) credit line will accrue interest if you allow it to sit idle and don’t draw from it. Based on today’s interest rates (which fluctuate periodically), you can see how much your Line of Credit will expand over time. For fun, the Calculator also shows you how much your monthly income will increase if you use the reverse mortgage to pay off an existing mortgage. (The idea is that if your previous $800 mortgage payment disappears, you will spent $800 less every month after you obtain a reverse mortgage, and this $800 can be thought of as a positive change in your monthly cashflow).

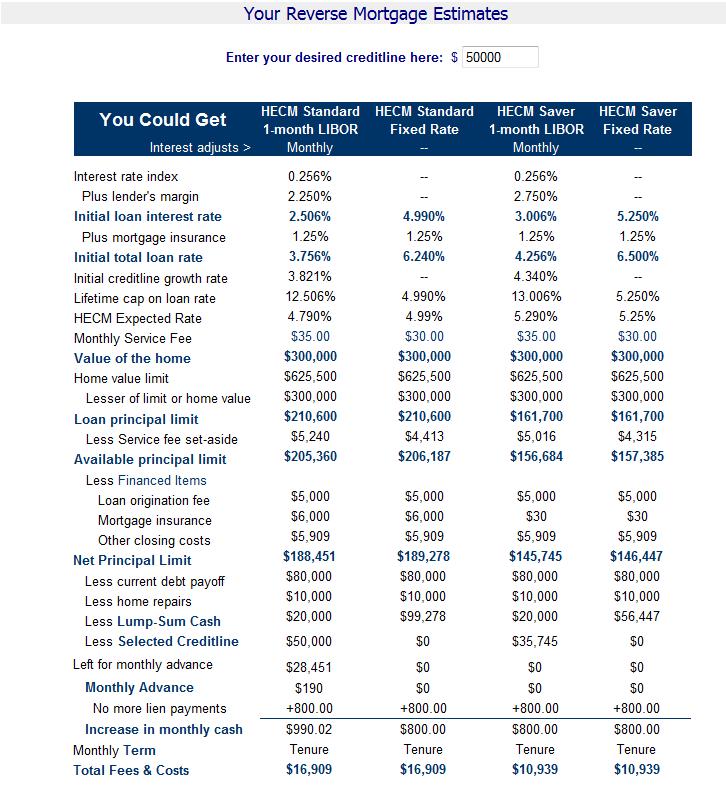

Technically, you can stop here. If you’re curious, Click on the Estimates button at the bottom of the screen to see how these figures are calculated. You can see first how the loan rate is basically a summation of the interest rate (dictated by FHA for fixed-rate mortgages and by investors for variable-rate mortgages), plus lender’s margin (which must be factored into a variable rate mortgage), and a 1.25% annual FHA insurance premium (which protects you from owing more than your home is worth when your home is sold and the reverse mortgage is repaid).

Based on the estimated value of your home (which can’t exceed $625,500 for purposes of calculating the reverse mortgage loan amount) and your age, the Calculator will determine how much you are eligible to borrow. It will subtract the Service Fee Set Aside (SFSA), which is paid upfront as an amalgamation of all of the $35 monthly service fees that the lender collects over the life of the mortgage. It will further subtract origination fees, upfront mortgage premium (only for HECM Standard reverse mortgages), and other closing costs, since these are financed into the mortgage and not paid out of pocket. (You can view Total Fees & Costs at the bottom of the table). After all of these deductions, you can see your Net Principal Limit. This will be further tweaked depending on the optional inputs you entered and the method that you elect to receive your cash (tenure, line of credit, lump-sum payment).

Of course, these figures represent estimates only. Different lenders may offer slightly different promotions/terms. If you decide that you want to move forward with a reverse mortgage, the next step is to start speaking to specific lenders/brokers.

These days, the print and online media are filled with stories of reverse mortgage borrowers that feel they were wronged by their lender. Typically, they report that everything was going fine until they were forced to (temporarily) move out of their homes, at which point the reverse mortgage was recalled by the lender. Critics cite these stories as evidence that reverse mortgages are inherently risky and inherently awful. The way I see it, however, the blame for such horror stories resides primarily with the borrower, who failed to understand the implications of moving out.

There is a misconception among borrowers that reverse mortgages are vastly different from regular loans, and that because they are insured by the FHA, the borrower is under no immediate obligation to repay the loan. In reality, a reverse mortgage is still a loan, and is subject to a standard loan agreement. Accordingly, the reverse mortgage needs to be repaid immediately (actually a one year grace period is available upon request) after the borrower permanently moves out of the home and/or passes away. Under such circumstances, if the borrower or his heirs are not able to repay the loan (plus interest and fees) in cash, the property will naturally be foreclosed upon and sold by the lender.

In order to combat fraud/abuse of the terms of the reverse mortgage, lenders typically define permanently moving out as residing outside of the property for more than one year. In practice, the lender will recall the reverse mortgage and initiate foreclosure proceedings if the one year time limit is breached.

Unfortunately, there are borrowers who are stricken with health problems that require extended stays in hospitals, rehab centers, or even nursing homes. Such borrowers are understandably horrified when such stays are interpreted as moving out, and return to their homes only to discover that they have breached the terms of the loan agreement and that the reverse mortgage has been recalled by the lender. Even worse, such borrowers may have spent a significant portion of their savings on healthcare expenses, and cannot afford to repay the loan. As a result, the lender has no choice but to force the sale of the property.

That’s not to say that borrowers don’t also have rights. When the lender forecloses on the property, any proceeds left over from the sale of the house will be distributed to the borrower or his estate. If the reverse mortgage had only been outstanding for a few years, these proceeds should still be sizable. In addition, if the borrower has any desire to repay the loan in cash or through a fresh loan, he will typically be granted one year to make arrangements to do so. Throughout this entire process, the home belongs to the borrower. Even though the lender has a lien on the property (via the reverse mortgage), this is not equivalent to ownership.

Unfair as it may seem, borrowers should make sure they are aware of such clauses prior to signing the reverse mortgage contract. They should further make sure that they understand what will happen in the event that they are forced to involuntarily vacate their primary residence while the reverse mortgage is still outstanding, and that they have a contingency plan for such an occurrence. In the end, borrowers that determine that the risks of a reverse mortgage outweigh the benefits can use their discretion to simply not obtain one.

We’ve all heard the term “Baby Boomer,” but who’s familiar with “Sandwich Generation?” Basically, the term was coined to reflect the fact that Baby Boomers are sandwiched between aging parents and older children, both of whom have come to depend on them financially. In this context, reverse mortgages would seem especially well-suited for Baby Boomers.

The financial circumstances of Baby Boomers are somewhat unique: “Today, four out of five seniors own their own home outright…Even as they do, they have a lower median income than any demographic group.” This is compounded by the fact that they might have two generations of dependents to take care of, the older of which have long since retired while the younger is still a few years away from being financially stable and able to live independently. Longer lifespans and changing cultural norms (whereby it is acceptable for recent college graduates to live at home for several additional years) mean that this could become the norm. In other words, “Sandwich Generation” might apply to those at or near retirement age for the foreseeable future.

While the financial options of the Sandwich Generation certainly aren’t limited to obtaining a reverse mortgage, it nonetheless is an attractive possibility for a few reasons. First of all, the main issue of those who fit the profile of the Sandwich Generation is one of liquidity; they are house-rich and cash-poor. While they might have enough cash to support themselves, they may not have enough to simultaneously support their parents and children. A reverse mortgage would provide them with ample cash to take care of their children until they are financially independent and their parents until they pass away.

Moreover, unlike other possible solutions, a reverse mortgage would allow the primary borrowers (and their kin) to remain in the same property even as they are drawing down its equity. This is a crucial benefit for Sandwich borrowers, since multiple generations are probably living under the same roof. For these borrowers, downsizing into a smaller home to free up available cash probably isn’t a realistic option.

Of course, reverse mortgages are not without risks and drawbacks, especially for the Sandwich Generation. Such borrowers are probably very close (or just past) the age of retirement, which means that they can expect to live another 20 years if they are healthy. While the the Reverse Mortgage would certainly enable them to help their parents and children for as long as they require such help, it would also expose their finances to considerable strain. 10 years later, they might have spent all of the proceeds from the reverse mortgage and exhausted a large portion of the equity in their homes, leaving them dangerously vulnerable in the event of a crisis (health or otherwise).

That is why it is vitally important that Sandwich Generation reverse mortgage borrowers (and all borrowers for that matter) to have solid financial plans which address not only their current financial situations but also their future circumstances. While it is admirable that borrowers would want to help support their loved ones, they must make sure that they have the means to first support themselves, now and in the future. It is not enough that a reverse mortgage will tide one over temporarily. Rather, borrowers must have the ability to continue to support themselves even after the reverse mortgage has exhausted itself.

For potential borrowers that pass this test and meet all of the other requisite criteria, a reverse mortgage is worthy of consideration.

The reverse mortgage rumor mills had been buzzing for months, and on October 4, the FHA finally unveiled its new Home Equity Conversion Mortgage (HECM) Saver product.

The HECM Saver is designed to solve two problems: the high costs of obtaining a reverse mortgage, and the potential insolvency of the FHA. In addressing the first issue, the HECM Saver can be obtained without an upfront insurance premium (actually it was reduced to .01% of the principal). To compensate, borrowers will be assessed a larger annual insurance premium (1.25%, compared to the former .5%), which will provide the FHA with ample reserves in the event of default.

The HECM Saver will feature principal limits that are 10-18% lower (depending on borrower age and prevailing interest rates) than the HECM Standard. Its redesign will probably make it more attractive to borrowers with shorter time frames. Previously, one had to worry about keeping a reverse mortgage for a certain number of years in order to rationalize the high upfront costs. Now, these costs will be limited to origination fees and the Service Fee Set Aside (SFSA), which some lenders are waiving or lowering anyway. For better or worse, this means that borrowers can now obtain (smaller) reverse mortgages concern for their time horizons.

The HECM Standard will change as follows: the initial insurance premium will be raised from 1.25% to 2%, and the annual insurance premium will be hiked from .5% to 1.25%, in line with the HECM Saver. However, principal limits will remain at the elevated levels, implemented recently by the FHA in response to complaints. (The current maximum for both HECM products is $625,500).

For those borrowers that have already decided to obtain a reverse mortgage, they must choose between the HECM Saver and the HECM Standard. Due to its lowered costs, the HECM Saver is obviously preferable. Those that have higher borrowing needs (due to an existing primary mortgage or for other reasons) may have no choice but to obtain an HECM Standard and compensate the FHA for the added risk by paying a 2% upfront mortgage insurance premium.

Speaking of the FHA, this news is certainly good for the organization, and by extension, for taxpayers. It makes it less likely that the FHA will require a cash infusion and more likely that it will be able to continue operating as a self-sufficient, stand-alone program.

According to a recent HUD data release and a related report by New View Advisors, fewer borrowers are prepaying their reverse mortgages. (Prepayment refers to the decision to voluntarily repay a reverse mortgage prior it it becoming due, which is usually triggered only by the borrower’s death or change of primary residence). Based on a comparison of 2007 loans with 1999 loans, New View determined that mortgage prepayments have been falling.

Amazingly, this has taken place even as reverse mortgage rates have fallen. When conventional mortgage rates decline by more than 1-2%, it will usually spur a wave of refinancing. This is apparently not the case with reverse mortgages. The implication is that even though HUD has lowered the interest rate floor on reverse mortgages from 5.5% to 5%, it probably won’t effect existing borrowers.

This phenomenon speaks both to the nature of reverse mortgages and the mindset of reverse mortgage borrowers. Since reverse mortgage borrowers don’t make monthly payments, they are less inclined to appreciate the savings associated with lower interest rates. A reverse mortgage refinancing is in fact much more likely to be a cash-out refinancing, as the interest savings are given out to the borrower upfront in the form of a higher loan maximum.

For confirmation of this, one need look no further than the 1999 borrowers in the New View study. As home prices rose, these borrowers became increasingly more likely to prepay (i.e. refinance), because doing so would immediately put more cash in their pockets. Of course, many of those mortgages are now underwater, but this should concern neither borrowers nor lenders, thanks to the mandatory FHA insurance. After the collapse of the housing bubble, the FHA has understandably made it less desirable for reverse mortgage borrowers to refinance, by maintaining an interest rate floor and by lowering loan limits.

New View also made some interest observations about how loan repayment varies with age, “with prepayment rates rising from 3.5% for 62 year olds, 6.9% for 77 year olds, and 26.1% for borrowers 90 and older.” This correlation has remained intact even as overall prepayments have fallen. On the one hand, it makes sense that older borrowers would be more inclined to prepay their reverse mortgages, perhaps having exhausted the benefits and wanting to prepay themselves rather than allowing their heirs to sort it out. On the other hand, the benefit of refinancing would be greater for youngish borrowers since the interest savings accrue over a longer period of time.

In short, if/when home prices start to appreciate, the data suggests that we could see a wave of prepayments. Until then – regardless of how far interest rates fall – borrowers probably won’t move.

Fore more information about refinancing a reverse mortgage, please read an earlier post on the subject.

Retirement Account? Check! Social Security Payments? Check! Pension? Check! Investment Portfolio? Check! Savings Account? Check! Real Estate? Check! Credit card? Check! Reverse Mortgage?

I would like to follow up on my post last week (“Financial Planners Don’t Understand Reverse Mortgages“) and ponder an interesting question: Does debt, specifically in the form of a reverse mortgage, deserve a place in your retirement planning? When a homeowner makes the transition into retirement, is it worth pondering a reverse mortgage as part of an overall retirement “strategy.” If so, under what circumstances, if any, would a reverse mortgage be justified?

For the record, I’m not a financial planner, and I’m about to offer specific tips on investing one’s retirement savings.That is something only a real financial planner or investment adviser can do. Still, it’s reasonable to say that as one ages, one’s financial planning should aim to become less risky and more conservative. That means moving from stocks to bonds to cash, moving from illiquid investments into liquid assets that can be drawn from immediately if necessary. That also usually means eliminating debt.

In this context, reverse mortgages would appear to have a contradictory role. On the one hand, they are the epitome of liquidity; after being issued, they can be drawn from until the lending limit is breached. On the other hand, it represents debt, and most financial planners advise retiring borrowers to eliminate debt as they move into retirement. At the same time, a reverse mortgage is different from conventional debt since it is repaid through the sale of the property and not in periodic installments. In addition, if used to phase out a conventional mortgage, it can have the effect of eliminating debt in the practical sense. (To be fair, in the actual sense, one form of debt is actually being swapped for another).

It’s fair to say that for those that own their homes outright, have stable sources of income (from social security, pension, etc., if not from actual work), and healthy personal balance sheets (assets well exceed liabilities), a reverse mortgage isn’t necessary. Sure, it would be nice to monetize one’s home and have access to a line of credit, but a price is paid (in the form of origination fees, insurance premiums and eventually, interest payments) for this luxury. Since reverse mortgages can be usually be processed quickly – they don’t require the credit checks and documentation of conventional mortgages – it’s probably better to wait until your financial position and lifestyle preferences actually necessitate obtaining one.

For those of you that don’t own you homes outright and lack the wherewithal to repay their primary mortgages, you could consider obtaining a reverse mortgage. This would serve to eliminate debt (aka risk) and to free up cash/income that you had otherwise used to make mortgage payments. For those that own their homes (and don’t want to move!) but have weak financial positions, a reverse mortgage would buttress your monthly income, if taken in installments.

For all borrowers, the proceeds from a reverse mortgage should only be used for home, living, healthcare, and related expenses. They shouldn’t be obtained with the intention of investing the proceeds in other financial products, such as stocks, bonds, annuities, etc, and to supplement other, existing sources of income.