Since your credit history and personal financial situation are not examined when applying for a reverse mortgage, the only real obstacle is an inadequate level of home equity. That’s because reverse mortgage borrowers must use the proceeds from the reverse mortgage first to pay off any primary mortgage debt. (Of course, those without any primary mortgage debt need not worry about this provision).

If you have significant (i.e. loan balance exceeds 50% of the value of your home) primary mortgage debt, you should consult HUD Principal Limit Factors. This is a table of HUD-mandated principal limits, broken down by age and interest rate, and expressed as a percentage of the value of your home. The principal limit will also vary depending on which type of Home Equity Conversion Mortgage (HECM) you wish to obtain. HECM Standard reverse mortgages carry higher principal limits than HECM Saver reverse mortgages, but require a significant upfront insurance premium.

To determine the maximum amount that you are eligible to borrow, simply scroll down to “5% Interest Rates,” and find the percentage listed next to your age. For HECM Standard loans, the principal limit varies between 61.9% and 77.6%, depending on your age. For HECM Saver loans, the range of principal limits is 52.3% to 61.0%. You will notice that as your age increases and the interest rate declines, the amount of cash you can potentially receive increases proportionally. However, since the current HUD-mandated interest rate floor is 5%, all values below 5% show the same principal limits.

When considering your eligibility, you should take the loan limit and subtract 7% (5% for HECM Saver Loans), which is a conservative estimate of the total closing costs, origination fee, upfront insurance premium, and Service Fee Set Aside (SFSA). If your primary mortgage debt exceeds this figure, you are not eligible to obtain a reverse mortgage.

Due to falling home prices and proportionally declining home equity, this is unfortunately a situation that nearly half of all homeowners will find themselves in. The only immediate solution is to use some of your savings to pay down your primary mortgage debt until it falls below the concomitant HUD principal limit. Otherwise, you can wait a few years under the hope that home prices (and your home equity) will rise or interest rates will fall. (Regardless of what happens, the maximum loan amount will automatically increase by .2-.4% for every year that you age).

Unless HUD raises the principal limits (which is unlikely given the program’s recent financial troubles), you might find yourself sadly shut out of the process.

It seems that there is some confusion regarding the costs associated with a reverse mortgage. In my opinion, this is not the fault of reverse mortgage lenders – though, perhaps they could do a better job in this aspect – but rather do to the very nature of reverse mortgages. Since the initial flow of funds is entirely one-way, borrowers often don’t conduct adequate due diligence and fail to properly understand all of the costs. In any event, allow me to offer some clarification.

The first set of costs are levied when the borrower initially obtains the reverse mortgage. First is the origination fee, which is charged directly by the lender in order to cover overhead and other administrative costs. Generally, this is assessed as a fixed percentage of the value of the home: 2% of the appraised value of the home up to $200,000 and an additional 1% on any portion exceeding $200,000. Then, there are a handful of third-party closing costs, including appraisal fee, credit report, title insurance, recording fee, flood certification, etc. Finally, there is the service fee set aside (SFSA) – $35/month x ~10 years – which the lender will draw from every month for as long as the reverse mortgage remains outstanding. [It should be noted that for promotional/competitive purposes, some lenders will do away with the origination fee and SFSA, and potential borrowers are encouraged to shop around].

Next, the mortgage insurance premium (mip) must be paid to FHA (assuming that the loan is a Home Equity Conversion Mortgage (HECM), as opposed to a proprietary reverse mortgage; this protects the lender (and indirectly, the borrower) from the possibility that the property could one day be worth less than the mortgage balance. With an HECM Standard, the borrower is charged an upfront mortgage premium of 2% of the loan value, whereas the upfront insurance premium for an HECM Saver is basically nil. Borrowers must also pay an annual insurance premium of 1.25% for as long as the reverse mortgage remains outstanding.

The largest (cumulative) cost for all borrowers is interest. Interest is assessed monthly, whether the interest rate is fixed or variable. Since reverse mortgages are always negatively amortizing, the interest is added on the loan balance, and compounds exponentially over the life of the mortgage. If the value of your home doesn’t appreciate at a rate similar to your reverse mortgage rate of interest, then your home equity will steadily erode to the point that it could become negative. If you have aspirations of repaying your reverse mortgage before this point (or even if you don’t!), it’s important to stay abreast of the situation.

Technically, there aren’t any other costs associated with the reverse mortgage. For example, lender consultations and loan counseling are always available free of charge. However, since there is no escrow account associated with the reverse mortgage (unlike with a conventional mortgage), it is imperative that you continue to pay property taxes and hazard insurance premiums, as well as to spend money maintaining the property for as long as you continue to live there. Failure to do so represents a breach of the loan agreement and could trigger termination of the reverse mortgage.

At its annual meeting last month, the National Reverse Mortgage Lenders Association (NRMLA) formally introduced a new level of certification for which members are eligible to apply. Known as the Certified Reverse Mortgage Professional (CRMP), it is intended to designate that a reverse mortgage originator has achieved a certain level of experience, education, and ethics.

According to the NRMLA, “Eligibility to apply for a CRMP designation requires that a loan originator have at least two years of experience and closed 50 reverse mortgages. Only then can they enter the process which includes 12 hours annually of continued education, participating in a three-hour interactive ethics training seminar, a background check and sitting for an exam. The certification is valid for three years, but a designee must recertify every year and obtain 12 hours of continuing education credits annually over that period.” In this way, the certification can serve as a point of competitive distinction. All else being equal, most borrowers would be more inclined to obtain a mortgage from a loan originator that had undergone the maximum level of training and received the highest designation currently bestowed by the reverse mortgage industry association.

From the standpoint of the NRMLA, the certification will not only be a source of income, but will also provide an ethical boost to the reverse mortgage product and to the industry in general. “The program is administered by an Independent Certification Committee comprised of NRMLA members that oversee the establishment of criteria, eligibility, testing and recertification.” In this way, the NRMLA can address claims that reverse mortgage borrowers don’t understand what they are agreeing to and aren’t aware of their other options.

Personally, I think this is a step in the right direction. It’s important that borrowers feel comfortable with their respective loan originators and not have to worry that vital information is being withheld so as to “facilitate” the transaction. By dealing with a CRMP loan originator, there should be a decreased likelihood that borrowers will be cajoled into obtaining a reverse mortgage when the conditions are not suitable. Meanwhile, the handful of professionals that have already been certified will be held to a higher standard, since they represent not only their respective lender, but also the industry at large.

Let’s just hope that the designation proves its worth and isn’t used cynically to lull borrowers into a false sense of security.

According to most surveys, the majority of current borrowers are satisfied with their reverse mortgages and have indicated that their lives are better off because of them. However, the operative word here is current. As Reverse Mortgage Daily concedes, little or nothing is known about how former borrowers feel. As a result, “The most fundamental question about the consumer impact of the HECM has yet to be answered.”

That the majority of current borrowers are satisfied with their reverse mortgages is not altogether surprising. After all, the initial flow of funds is entirely one way. Borrowers sign a few forms, have their homes appraised, and then receive significant sums of money. There are no monthly payments, and the lender will only come calling if the terms of the loan agreement are breached (i.e. if the borrower neglects to pay taxes and hazard insurance premiums, or fails to maintain the property). In the beginning, horror stories are rare, and except in cases of outright fraud – which plague every industry – most loans are originated in a scrupulous manner. How could anyone not be satisfied with such a product?

As for borrowers’ level of satisfaction over the long-term, this is less clear. The immediate impact of a reverse mortgage is necessarily to improve one’s financial situation. If there was an existing primary mortgage, the reverse mortgage eliminated it and any need to make monthly payments. If the primary mortgage had already been paid off, the reverse mortgage borrower will suddenly find themselves with substantially more money. Unfortunately, this is really just an illusion, since these funds ultimately need to be repaid.

Reverse mortgages are always negatively amortizing, which means that principal begets interest, which in turn, begets more interest. In practice, that means that the reverse mortgage loan balance will grow at an exponential rate. Depending on the rate of interest and the initial loan balance (as a proportion of one’s home equity), the loan balance will probably approach (and even exceed) the value of the home after one or more decades. That means that if the reverse mortgage is terminated (whether by the borrower or the lender), the majority of the proceeds from the sale of the home will probably go towards repaying the loan.

Of course, borrowers should understand all of this when they obtain the reverse mortgages and the proceeds are distributed. In practice, however, it’s not known whether borrowers are willing to acknowledge this or actually do understand it. Ideally, reverse mortgage borrowers would continue living in their homes until they pass away, in which case, this wouldn’t be much of an issue. Given that most reverse mortgage borrowers probably have weak financial positions to begin with, having to move out prematurely without any cash or leftover home equity would be nothing short of devastating.

And I think it goes without saying that such borrowers would probably voice regret about having obtained the reverse mortgage in the first place. For all we know, a substantial portion of all borrowers might sing a different tune when they receive the “bill” for the reverse mortgage and are confronted with the reality that the money they received was never free.

The problem is, we just don’t know.

As the foreclosure crisis continues unabated, experts continue to trawl for solutions. There are mortgage modifications and principal write-downs. Some have called for a national foreclosure moratorium. States are loaning unemployed borrowers money so that they can continue making mortgage payments. Borrowers are suing lenders in a last-ditch attempt to avoid foreclosure. I’d like to add another potential solution to the list: reverse mortgages.

For those that are struggling to make payments on their primary mortgage and/or are facing foreclosure, a reverse mortgage would seem to represent an ideal fix. Under a reverse mortgage, you can cease making monthly payments immediately, and you are entitled to stay in your home until you pass away, as long as you continue paying property taxes and hazard insurance premiums.

However, there are a few stipulations. First, you must be older than 62 years old in order to obtain a reverse mortgage, which means that only a small portion of mortgage borrowers are even eligible. In addition, your home equity must exceed a certain percentage in order to be eligible (the exact percentage depends on your age and interest rates). That’s because the entire primary mortgage must be paid off upon obtaining a reverse mortgage as well as because the FHA limits the proportion of your property value that you can borrow against. Finally, since a substantial portion of the reverse mortgage proceeds are probably being used to retire your primary mortgage, your cash position probably won’t improve much. Given that your home equity will also decline over time, it is imperative that you have savings and other sources of cash that you can use to continue supporting yourself.

When contemplating using a reverse mortgage to repay your primary mortgage, it’s important to remember that you are merely swapping one form of debt for another. In other words, the reverse mortgage – just like the primary mortgage – ultimately needs to be repaid. The advantage is that you can repay the loan from the sale of your home (following the death of the primary borrower) and can continue to reside in the home in the interim. The disadvantage is that because reverse mortgages are always negatively amortizing (i.e interest compounds on top of interest), you might end up owing more over the life of the loan than if you had merely continued to make monthly payments on your primary mortgage.

In short, reverse mortgages are really most appropriate for borrowers that are having difficulty making monthly payments for their primary mortgages and that are opposed (for whatever reason) to moving into a less expensive home.

It is technically possible to obtain a reverse mortgage for the purposes of consolidating / repaying other debts. However, prospective reverse mortgage borrowers needs to fully understand the implications of doing so. Moreover, since it is only economical in certain situations, borrowers need to think critically about how such will impact their personal financial situations and whether there might be better alternatives.

On the surface, reverse mortgages would seem to be eminently suited for debt consolidation. For example, you could use a reverse mortgage to eliminate an existing primary mortgage. Basically, you will trade your monthly payments for one big balloon payment. Unlike a conventional mortgage – which involves greater scrutiny – reverse mortgages can be obtained for any reason, and the proceeds can be spent however the borrower wants. Moreover, the reverse mortgage will inherently eliminate the need to continue making monthly payments, since it needs to repaid only when the last primary borrower passes away or moves out. Finally, a reverse mortgage may carry a lower rate of interest than other types of consumer debt.

On the other hand, just because lenders allow borrowers to obtain reverse mortgages in order to achieve debt relief doesn’t mean they should actually be used for that purpose. Under a reverse mortgage, interest will continue to accumulate on top of interest to the extent that one’s entire home equity can be wiped out over the course of a decade or two (depending on the size of the loan). Some would consider that a reasonable trade-off for alleviating the burden of having to repay other debt, but it’s not necessarily an economical choice. In addition, when you factor in the annual insurance premiums and the fact that the reverse mortgage interest compounds on itself, the actual APR will probably be several per-cent higher than the nominal interest rate, further eliminating any financial impetus for consolidating debt.

Ultimately, it depends on the amount of existing debt, the corresponding interest rates, and one’s personal financial situation. If you have only a small amount of debt accumulating at a low rate of interest and a stable source of income, you should consider repaying the debt directly. Since reverse mortgages are negatively amortizing, obtaining one for even a modest amount can still rapidly erode your home equity.

If, on the other hand, the existing debt is relatively large and/or the interest rate is quite high, if making monthly payments is taxing your finances and the only way you can repay the debt is if you sell your home, then a reverse mortgage might be the only realistic solution to maintain solvency and stay in your home.

Just bear in mind that you will still have to find a way to continue paying property taxes and hazard insurance, as well as to maintain the property for as long as you reside there. Since you have already tapped your home equity, you will have to use personal savings and income to defray these costs. Unfortunately, if your personal finances are inadequate, you may have to consider selling your home and moving into a less expensive property. If need be, you can always obtain a reverse mortgage on that one instead.

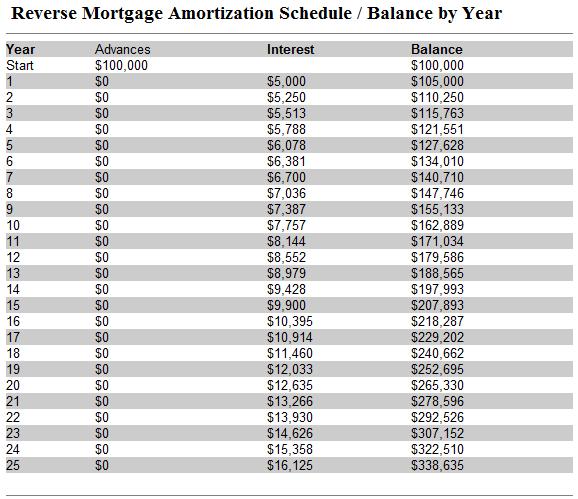

When you obtain a reverse mortgage, your lender should furnish you with – among other things – an amortization schedule, which is basically a table/graph of how the loan balance will change over time.

The amortization schedule for a reverse mortgage is unique because it is a negatively-amortizing loan. Since it is repaid all at one time only and (usually) only when the last primary borrower passes away, the loan balance for a reverse mortgage will increase over time. This contrasts with a conventional mortgage, the loan balance of which should decrease evenly over time and eventually disappear as a result of making monthly payments.

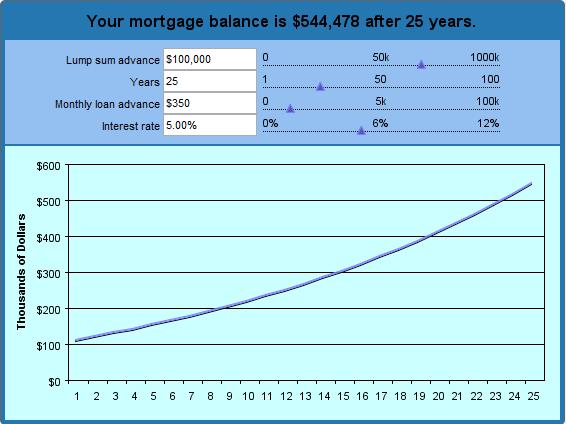

The best way to conceptualize this is to create a hypothetical amortization schedule even before you begin the process of shopping for a reverse mortgage. Using our reverse mortgage calculator, you can clearly see how your loan balance will increase (as interest and principal compound) until the reverse mortgage is repaid. Because you aren’t required to make monthly payments, the loan balance will grow exponentially, to the point that 15 years from now, it will accrue interest twice as fast as the current rate. 25 years from now, it will accrue interest 3 times as fast.

In the sample above, I keyed in a lump sum advance of $100,000 and term payments of $350 per month. I assumed an interest rate of 5% and requested a 25-year chart. (In other words, if I obtain a reverse mortgage at the age of 62, when I first become eligible, I can see how much I will owe by the time I am 87. Based on these parameters, the calculator determined that I will receive a total of $190,000 (lump-sum advance + cumulative monthly payments). Over this time, the loan will accrue $325,072 in interest, which means that the lender will be owed $515,072. Wow!

While you can adjust the parameters as you see fit, you should bear in mind a couple things. First, the actual interest rate (APR) will be even higher when you take into account closing costs and FHA insurance premiums. Second, this insurance protects you from owing more on your reverse mortgage than your home is worth (a real possibility if you stay in your home long enough), which means that the loan balance on an FHA-insured loan is only relevant insofar as you (or your heirs) ultimately intend to keep your house and pay off the reverse mortgage in cash.

With mortgage rates at record lows, many borrowers have moved to refinance their mortgages. Some have even refinanced multiple times over the last few years. Given that closing costs (for all mortgages) are rising and that refinancing often extends the duration of one’s mortgage, it might ultimately be more economical to obtain a reverse mortgage.

Consider that a refinancing could cost you 3-5% of the value of your home. Whether the fees are paid up-front or rolled into the loan balance, a refinancing is expensive. Of course, the idea is that you will reduce your monthly payment and/or save money in interest charges over the life of the loan, and you would be foolish to refinance unless you could achieve at least one of these outcomes.

If you are already retired and/or eligible for a reverse mortgage, why not re-apply the cash that you would have to pay upfront for a refinancing towards obtaining a reverse mortgage instead. Surprisingly (given that reverse mortgages are often lambasted for their high costs), the cost of obtaining a reverse mortgage may in fact be cheaper than going through the process of refinancing. For example, the recently introduced Home Equity Conversion Mortgage (HECM) Saver eliminated the upfront FHA insurance premium, which was the largest upfront cost for most reverse mortgage borrowers. As if that weren’t enough, many lenders offer additional financial incentives to borrowers, such as no-closing cost loans.

In addition, while reverse mortgage rates aren’t as low as mortgage rates (due to an FHA rate floor), there is a good chance that they are lower than the interest rate attached to your current mortgage, especially if you are contemplating a refinance. Not only that, but the nature of reverse mortgages is such that the flow of funds will be reversed. Instead of making a (smaller) mortgage payment every month, you will receive a (relative to when interest rates were higher) larger one. The two main offsets to savings are the annual insurance premiums and the fact that your reverse mortgage negatively amortizes, meaning the balance will increase over time.

On some level, it’s ridiculous to compare a reverse mortgage with a refinanced mortgage, since the two are fundamentally different. At the same time, the decision behind both stems from a common motivation to save money on one’s mortgage. In short, the greatest savings can probably be achieved by refinancing, but you can reshape your financial situation, alter your monthly income stream, and eliminate the burden of monthly payments altogether by instead obtaining a reverse mortgage.

Be sure to read my complete overview of the financial and non-financial pros and cons of reverse mortgages for more guidance on making this decision.