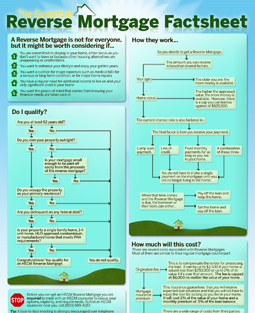

We have recently created a free visual guide for seniors who are looking to understand how reverse mortgages work.

Earlier this year, Ginnie Mae moved to make it more difficult for financial institutions to issue HECM reverse mortgage-backed securities (HMBS). As I’ll explain below, this could have serious implications for the reverse mortgage industry, and exacerbate the slowdown in lending that is already underway.

Ginnie Mae performs the same function for reverse mortgage lending that Freddie Mac and Fannie Mae perform for conventional mortgage lending. By purchasing (reverse) mortgage-backed securities, Ginnie Mae indirectly relieves lenders of their capital commitments and enables them to originate new loans. If not for Ginnie Mae specifically and the MBS system in general, mortgage lending would be significantly more risky for lenders, and necessitate stricter standards and higher costs for borrowers.

HECM reverse mortgages are partially immune from this problem since they are necessarily insured by HUD. In other words, lenders bear virtually zero risk for the loans that they underwrite, since they can ultimately file a HUD insurance claim in the event of borrower default. Still, the majority of reverse mortgage lenders remain heavily dependent on the HMBS market, because they couldn’t possibly commit enough capital to underwrite all the reverse mortgages themselves. ($100,000/reverse mortgage X 1,000 loans per year > most reverse lenders’ lending capital).

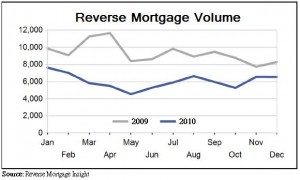

Last year, Ginnie Mae stopped accepting new HMBS issuers in order to conduct a feasibility study of its reverse mortgage MBS operations. The purpose was to proactively address any concerns about overexposure to risk, and to avoid finding itself in the same position as the FHA’s reverse mortgage program, which had earlier teetered on the brink of insolvency. By no coincidence, reverse mortgage lending volume declined in 2010.

Now, Ginnie Mae has announced that it will resume accepting applications, but that all issuers will be subject to much higher standards beginning in October 2011. Suffice it to say that only large financial institutions (defined in terms of higher net worth, liquid assets, and capital ratio requirements) will be allowed to participate, and that fees for everyone will be higher.

In short, the good news is that things are basically back to normal with Ginnie Mae and the MBS market. The bad news is that some issuers might be reluctant/unable to participate, leading to further declines in reverse mortgage lending activity in 2011-2012.

According to a recent data release, the HECM Saver Reverse Mortgages were issued in December 2010. That might not seem like much, until you realize that it implies a gain of 120% in only one month! It seems unlikely that the HECM Saver will revive the ailing reverse mortgage industry, but at the very least, it represents a solid alternative to the HECM Standard.

The HECM Saver was introduced in October 2010 to great fanfare. It differs from the HECM Standard only in the absence of an upfront FHA insurance premium, which is offset by smaller loan amounts. The product was designed to be less risky for lenders and to be less expensive for borrowers, and it appears to have filled a solid niche in the the reverse mortgage marketplace.

In fact, the Wall Street Journal recently reported that the HECM Saver reverse mortgage compares favorably with Home Equity Line of Credit (HELOC). Even when you factor in the annual insurance premium of 1.25%, the total interest rate is still apparently below current HELOC rates. Moreover, the reverse mortgage variable rate and HELOC rate are typically derived from similar rate indexes, which means that this spread should remain constant, regardless of any fluctuations in interest rates.

While the WSJ conceded that HECM reverse mortgage closing costs are usually higher than the fees associated with obtaining a HELOC, it offered contradictory examples which downplayed its significance. It featured one borrower that had obtained an HECM Saver in order to avoid temporarily dipping into savings, and who planned to repay the reverse mortgage as soon as his investments recovered. However, it also featured a different borrower that planned to deliberately hold a reverse mortgage for longer period of time, in order to amortize the closing costs over a longer period of time.

Without knowing more information, it’s impossible to say whether either borrower made the right choice, financially. Short-term HECM Saver borrowers will end up paying a higher APR when fees are taken into account, while long-term borrowers risk paying compound interest and steadily losing their home equity. For both sets of borrowers, then, the key is looking at a side-by-side APR comparison for the HECM Saver and a HELOC, and decide accordingly.

To be fair, there are certain intangible benefits of choosing the reverse mortgage (over a HELOC), namely that you don’t have to make monthly payments and that the lender can’t decide to suddenly revoke the loan if market conditions change. For some borrowers, this might be enough to offset the higher closing costs.

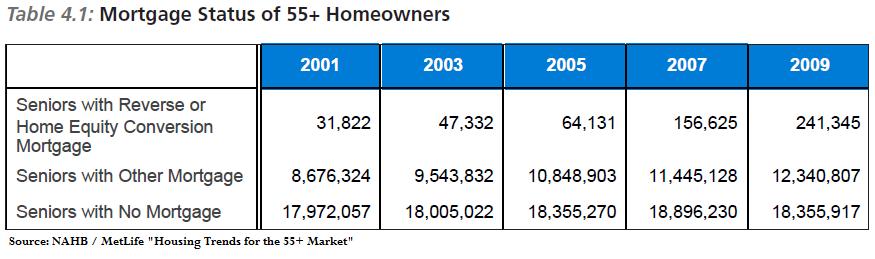

As I reported in my previous post, reverse mortgage lending volume has been shrinking and would appear to be trouble. As a new report by the National Association of Home Builders (NAHB) and MetLife points out, however, this could be about change. to Within the next couple decades, a handful of demographic drivers could spur fresh demand for reverse mortgages.

According to “Housing Trends Update for the 55+ Market,” aging baby boomers could soon constitute the majority of American homeowners: “The share of households age 55+ is projected to grow annually, and to account for nearly 45% of all U.S. households by the year 2020.” Based on some rough math, that means that almost half of US homeowners will be eligible for reverse mortgages in 2027. When you consider that only .8% of seniors currently hold a reverse mortgage (compared to 40% with outstanding primary mortgages), it’s clear that the potential for new customers is still vast.

The report also indicated that, “Only 55% of the new age-qualified active adult home buyers who made a down payment reported that it came from the sale of a previous home, significantly down from 92% in 2007.” Due both to the drop in housing prices and the economic recession, almost half of senior homebuyers are being forced dip into savings when purchasing a new home. This phenomenon would seem to imply further potential for growth in reverse mortgages for purchase loans.

Some other interesting factoids include the following: the average reverse mortgage borrower is 77 years old and comes from a household with 1.7 persons. They are unlikely to hold a Bachelors Degree and are typically white. The average property value is $225,000 Average household income for reverse mortgage borrowers was reported to be only $35,000, significantly below their mortgageless peers and also well below those with outstanding mortgages. For better or worse, this shows that the majority of reverse mortgage borrowers would appear to be under genuine financial strain and probably exhausted all of their other options before turning to reverse mortgages.

Finally, “reverse mortgage borrowers and seniors without mortgages stayed in their homes much longer, 24 and close to 27 years respectively, compared to 55+ homeowners who are still paying down their mortgage, 15.6 years.” This would seem to validate reverse mortgages, insofar as they enable seniors that have a sentimental attachment to their homes to continue living in their homes.

In short, I think that the NAHB report painted an optimistic portrait of the reverse mortgage. The figures it provided are consistent with the reverse mortgage surveys that revealed a high degree of borrower satisfaction. In addition, the aging of the baby boom generation, combined with the financial peril of the last few years should ensure that borrower demand for reverse mortgages should remain strong for the immediate future.

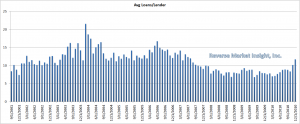

According to Reverse Mortgage Insight, the reverse mortgage lending seems to be caught in a downward spiral. On a year-over-year basis, volume is now declining at a precipitous pace. If there is any silver lining, however, it is is that the number of reverse mortgage lenders also seems to be dwindling, such that those lenders that have survived have actually experienced an increase in business.

Overall, total reverse mortgage volume fell 35% to 72,748 in 2010, compared to 111,924 endorsements in 2009. This marked the second consecutive year of decline, and worryingly, a quickening of the pace. It’s difficult to explain this trend. After all, the tightening of lending standards that have plagued conventional mortgage lending wouldn’t be expected impact reverse mortgage lending. Given the financial crisis, you would think that volume would be rising, not falling.

Perhaps the decline is being driven by a drop in home prices, and a proportional decrease in home equity. According to a January 2011 New York Fed research report (Household Debt and Saving during the 2007 Recession), “When home prices began to fall in 2007, owners’ equity in household real estate began to fall rapidly from almost $13.5 trillion in 1Q 2006 to a little under $5.3 trillion in 1Q 2009, a decline in total home equity of over 60%. At the end of 2009 owner’s equity was estimated at $6.3 trillion, still more than 50% below its 2006 peak.”

This decline in home equity has rendered a large proportion of potential borrowers – those that couldn’t borrow enough to repay their primary mortgages – completely ineligible for reverse mortgages. It has also made reverse mortgages less attractive for other potential borrowers, by making it less likely that they could borrow enough to offset the high upfront costs.

On the bright side, the number of active reverse mortgage lenders fell 29% in 2010, to 2,222. According to Reverse mortgage Insight (Don’t ask me about the math…), that has lifted the average number of loan endorsements per lender to 11.7, the highest level since 2007, and a more than 50% increase from 2009. In fact, 6 out of the top 10 lenders recorded an increase in volume in 2010. Due to Bank of America’s just-announced exit from the reverse mortgage industry, this trend is expected to continue in 2010. (BofA was the second largest reverse mortgage lender by volume, behind only Wells Fargo).

As for how the industry overall will fare in 2011, I think that depends largely on the housing market. Unfortunately, most housing analysts think that prices will either stagnate or continue to fall for the next couple years, which is probably a bad omen for reverse mortgage lending.

Those of you that read my earlier post, “How to Choose a Reverse Mortgage Lender,” might recall that Bank of America is the second largest reverse mortgage lender by volume in the entire country. Thus, BofA’s news that it was exiting the reverse mortgage business came as nothing short of a shock.

Officially, the move is “due to competing demands and priorities that require investments and resources be focused on other key areas of our business.” In other words, its management made a strategic decision to refocus the company’s mortgage unit on its core business. While 10,000 loans a year and 5% market share made earned it the admiration of its competitors, reverse mortgages nonetheless represented only about 1% of overall mortgage lending and was really just an ancillary business for BofA. (By the way, BofA will continue to service its existing reverse mortgages).

Still, there aren’t many industries in which the company with the second largest market share and $4 Billion in annual loan volume would voluntarily quit, without first consider monetizing its business through either a sale or spin-off. For that reason, industry watchers have speculated that the decision was grounded more in Public Relations and Risk Management, than in business strategy. “Guy Cecala, publisher of Inside Mortgage Finance, said that Bank of America is trying to minimize its exposure to potential lawsuits. ‘You’re dealing with the elderly, you’re talking about taking away their homes when they die. That’s a bad set of variables there.’ ”

On the one hand, the fact that reverse mortgage lending actually declined in 2010 means it might be worth taking BofA at face value. On the other hand, the move also represents a calculated assessment that reverse mortgages have a tarnished image. Class action lawsuits – like the kind that conventional mortgagers are rushing to join – are probably unlikely. Still, BofA’s legal troubles continue to mount, and the company is being forced to adopt a more conservative approach to mortgage lending.

There are a couple of implications for the reverse mortgage industry. First of all, there is now a gaping hole, and it will be interesting to see whether it is filled by national reverse mortgage lenders are smaller, regional players. Second, it begs the question of whether BofA knows something that we don’t, and/or anticipates future problems stemming from its reverse mortgage lending operations. For now, Wells Fargo, the industry leader (now by an even larger margin) has no plans to follow suit. If it does, it will turn the industry on its head.

An estimated 30,000 reverse mortgages (~5% of the total) are now in technical default. Due to the sensitivity of the issue (and the potential for a Public Relations fiasco!), HUD recently issued guidance to all reverse mortgage lenders, urging them to avoid foreclosure at all cost. This development has important implications not only for those who are already in default, but for the entire pool of reverse mortgage borrowers.

Those of you who aren’t entirely familiar with reverse mortgages are probably wondering how it’s possible to default. After all, borrowers aren’t required to make monthly payments and are supposed to be protected from negative equity through their FHA insurance. What you may not know is that borrowers are still responsible for paying property taxes and hazard insurance premiums, as well as to continue maintaining the property, for as long as the reverse mortgage is outstanding.

Lenders might be inclined to look the other way when it comes to routine maintenance expenditures, but they can’t be afford to be lax with the payment of taxes and insurance premiums because it puts their collateral (the property) at risk. “HUD regulations allow lenders to make tax and insurance payments on behalf of their elderly clients from the borrower’s available mortgage funds. However, once those resources are exhausted, the lender must advance funds to protect FHA’s interest and obtain reimbursement from the borrower.” (In fact, since the reverse mortgages are insured, lenders don’t really have any incentive to avoid default, because they will ultimately be compensated by the FHA for any losses, but that is another issue).

Since doing nothing would risk endangering the solvency of the entire reverse mortgage program, the FHA earlier this year instructed lenders to begin calling loans for borrowers who were in technical default. However, the ensuing backlash forced the it to reverse course, and the current guidance represents a tacit admission that the earlier approach probably wasn’t well thought-out.

According to the January 2010 Mortgagee Letter, foreclosure is to be a last resort for HECM borrowers in default. Instead encouraged to work with HECM borrowers in default to make their loans current. The FHA has allocated $3 million to a handful of HUD-approved counseling agencies, which are supposed to assist with the effort. Given that an estimated 70% of delinquent loan balances are less than $5,000, the industry is optimistic that foreclosure can be avoided. Peter Bell, President of the National Reverse Mortgage Lenders Association told Reuters, “There might be charitable sources, or families might decide to step in and pay the bill. Even if cases to do to court, I doubt very many judges are going to let lenders throw seniors out of their homes over a $5,000 liability. Courts may impose some settlements.”

On the other hand, this represents more of a band-aid than a long-term solution. It’s possible that some borrowers simply forgot (or elected not) to pay their property taxes and hazard insurance premiums, and that they will now be galvanized into doing so. At the same time, I think that a certain number of technical defaults (~5% is actually below

national delinquency rate for conventional mortgages) is sadly to be expected. Unless the FHA has aspirations to turn the reverse mortgage into a charity program, it will have no choice but to call the loans (and effect foreclosure) upon those borrowers that lack the means to stay current. Besides given that the number of delinquent loans has risen nearly 200% over the last two years, this issue is unlikely to go away anytime soon.

In the mean time, those borrowers that were in technical default prior to January 1 will probably be given a free pass. “Lenders will be contacting all delinquent borrowers by the end of April to lay out options including establishing re-payment schedules, restructuring of loans or to offer assistance from a HUD-approved consumer counseling service.”

According to ReverseMortgageDaily, some reverse mortgage borrowers have begun to deliberately pay down their reverse mortgages, sometimes with the intention of paying them off completely. While countering the loan’s negative amortization is admirable, however, this strategy raises questions about whether these borrowers might be better served by other types of loans.

Reverse mortgages are inherently negatively amortizing, which means that interest and principal accrue indefinitely until the loan is retired. Unless the value of one’s home appreciated at 5%+ per year, a reverse mortgage borrower would probably find himself with very little remaining home equity after as little as 10 years. Naturally, the only way to avoid this outcome – other than obtaining a smaller loan – is to make payments on the reverse mortgage much like you would with a conventional mortgage.

However, this goes against the very nature of the reverse mortgage, which were designed to bring financial security to retired (i.e. low income) borrowers. Because there is a serious risk that one day the loan will become negative equity (the loan balance will exceed the value of the home), the FHA charges borrowers a 1.25% annual insurance premium. By repaying the loan, borrowers are essentially alleviating lenders/FHA of this risk while still being charged for it.

I suppose one could argue that it’s nice to have the flexibility of not having to repay the reverse mortgage, in the event of financial hardship or a simple change of heart. In other words, one could obtain a reverse mortgage with the purpose of repaying it, and either lower or cease such repayment as the circumstances of one’s life change. In this way, the borrower gets to have his cake and eat it too.

Still, it’s worth pointing out that a conventional mortgage and Home Equity Line of Credit (HELOC) will almost always be less expensive than a reverse mortgage, and you should look into either of these possibilities if your cash needs are short-term and you expect to be able to repay the loan. Then again, these types of conventional loans are becoming more difficult and more expensive to obtain, and a reverse mortgage might be the only viable option for certain borrowers.

By way of the Consumers Union report (“Examining Faulty Foundations in Today’s Reverse Mortgages”), I recently became aware of a groundbreaking study conducted by the University of Iowa in 2007. The study tested the cognitive decision-making abilities of older persons, and their conclusions strike at the very heart of reverse mortgages.

The researchers behind Orbitofrontal Cortex Real-World Decision Making, and Normal Aging began with the premise that natural aging processes significantly degrade the brain’s prefrontal cortex in a substantial portion of older people. The resulting neural dysfunction, they hypothesized, might explain why many older people engage in faulty decision-making, and appear to be particularly vulnerable to fraud.

The results were startling: “As many as 35 to 40 percent of elders they studied had flawed emotional responses that stem from abnormalities that develop in the brain’s prefrontal cortex. The study also determined that these flaws were leading the seniors to make financial decisions based in part on reward and ambiguity, which follow the same approach used by individuals with acquired prefrontal lesions (traumatic brain injury).” For example, the researchers observed that some of the participants were susceptible to the truth effect, whereby they were more easily persuaded by repeated information, regardless of merit.

Unfortunately, the onset of cognitive decline may coincide with a period of life in which many critical, long-term (financial) decisions need to made, related to “investment of savings and retirement income, purchase of insurance and living trusts, estate planning, and sudden changes in financial roles following the death of a spouse.” As if the constraints posed by limited finances, a lack of income, and general uncertainty about the future weren’t enough, it now turns out that many of these seniors might also lack the proper neurological capacity to make logical decisions on these matters.

If this is the case, then the reverse mortgage system in its current form is probably inadequate. For example, 90% of counseling sessions are conducted over the phone, where there is no way to certify the identity of the borrower, let alone his decision-making capacity. As if that weren’t enough, it seems that that most borrowers treat the counseling session as a mere formality. By the time they are required to complete it, they have already made the decision to obtain a reverse mortgage and are probably far along the process. Finally, due to the truth effect and related phenomena, seniors are probably more easily swayed by reverse mortgage marketing, which is full of rosy thinking misleading claims, and tend to play short shrift to downsides/pitfalls.

According to Consumers Union, there are a couple important implications. First, the guidelines for reverse mortgage should be strengthened with tighter, more balanced language requirements. Second, the counseling session needs to be modified, not only to protect borrowers from unscrupulous lenders, but in some cases, to protect them from their own shortcomings.

When you consider the extraordinary number of people that are already (or will soon be) eligible for reverse mortgages, their $4 trillion in latent home equity, and the financial anxiety affecting senior citizens, you would think that the reverse mortgage business would be booming. While growth over the last decade has been impressive, however, 2010 was a fairly disappointing year, with only 100,000 new reverse mortgages issued. What’s holding the industry back? In one word: culture.

The statistics would certainly seem to suggest that Americans are comfortable with debt. Though this is undoubtedly the case, most borrowers nonetheless look forward to being debt-free. That is especially true when it comes to borrowing for a home, and there is a negative connotation associated with being a mortgage slave. After 30 years (perhaps more if the mortgage was refinanced) and hundreds of thousands of dollars in interest, being debt-free would be cause for celebration (and maybe even a ritual mortgage burning) by even the most stoic homeowners.

To then commit to obtaining a new mortgage might take more than some glossy brochures and a clever sales pitch. Why go through all of the aggravation of borrowing money to purchase a home and dutifully repay that loan, simply to undo all of that work with a fresh loan? After all, there is a certainly a tremendous amount of pride (not to mention security) in owning one’s home – the most fundamental possession – outright.

In addition, people naturally become more conservative as they age, and that is especially true when it comes to finances. Due to its costs and the fact that it represents an obligation, a reverse mortgage entails the assumption of risk. Those that have recently retired or are nearing retirement are not naturally inclined to take risks with their finances. In that sense, the only demographic that is eligible for the reverse mortgage is also perhaps the least likely to take advantage of it.

Finally, more than with any other possession, there is a great sense of personal nostalgia and connection attached to one’s home. Having lived in the same home long enough to repay a mortgage also means that many of one’s major life memories are associated with that home. By obtaining a reverse mortgage, a borrower must accept the strong possibility that the property will one day be sold to repay it. In other words, a reverse mortgage represents a sort of death knell for one’s home.

On the other hand, there may also exist the possibility that the home will need to be sold at some point anyway (either for financial reasons or simply because one’s heirs no longer wish to keep it), which means that this shouldn’t be a factor in obtaining a reverse mortgage. In addition, while there is something to be said for wanting to remain debt-free after repaying one’s primary mortgage, there is still a huge pool of eligible reverse mortgage borrowers that have yet to (or are unable to) repay their primary mortgages, and for whom financial conservatism isn’t realistic.

It is these borrowers that are best suited to obtaining reverse mortgages, and to whom the reverse mortgage industry should be spending the brunt of its time trying to convince.

This is precisely what the Citizens League, an advocacy group based in Minnesota, proposed in their recent report, “Moving Beyond Medicaid: Long-Term Care for the Elderly as a Life Quality and Fiscal Imperative.” If current trends continue, Minnesota’s Medicaid system will be impossible to sustain in its current form, and the solution may involve reverse mortgages.

The report offers some grim statistics about the situation in Minnesota, which can also be seen as a microcosm for a national problem. In sum, “40% of the long-term care expenditures for the elderly in Minnesota in 2004 were financed by Medicaid…Medicaid funding for long-term care for the elderly could grow nearly fivefold in Minnesota, from $1.1 billion in 2010 to $5 billion in 2035.” Assuming that taxpayers balk at financing this entire burden using public funds, an alternative system for financing long-term care (for indigent residents) will nee to be created.

While a handful of potential solutions were laid out, I want to focus on the one that involves reverse mortgages. Basically, the Citizens League has suggested eliminating the home-exemption rule, whereby one’s home is not factored into eligibility for medicaid funds. Under the proposal, recipients of medicaid could be prodded to obtain reverse mortgages instead of or in conjunction with medicaid funds. Of course, the reverse mortgage would have to be redesigned in order to provide an additional level of protection for borrowers and to keep costs at an absolute low. Loan amounts would be small (in order to minimize risk and costs), and the proceeds could only be used for medical and long-term care expenses.

The benefits to state governments would be fantastic: “It has been estimated that replacing Medicaid’s home exemption with “reverse mortgages” could save Medicaid from $5 to $20 billion a year in the United States. When you consider that states are increasingly strapped for cash and that taxpayers are demanding cuts in public programs, this idea is a practicable way to shift some of the medicaid burden onto those that benefit directly from its services.