Having made the decision to obtain an HECM reverse mortgage, many prospective borrowers deliberately do not shop around. They figure that because it’s a standardized product insured by a government agency, therefore every lender must offer identical terms at identical rates. In fact, nothing could be further from the truth. No Closing Cost Reverse Mortgages represent a case in point.

In response to charges that due to high upfront costs, reverse mortgages were prohibitively expensive, many lenders engaged in a conscious effort to lower the costs. Given that an interest rate floor is determined by the FHA, there was/is only so much they could do. In some cases, they paid the upfront insurance premium for borrowers. In other cases, they eliminated their origination fees. Still other lenders agreed to pay certain third party closing costs on behalf of borrowers.

Of course, lenders must have some kind of financial incentive for reducing costs, especially since the industry has not (yet) collectively resolved to lower costs together. In fact, some lenders stipulate that they will only waive their closing costs if the loan amount exceeds a certain value. No Closing Cost proprietary reverse mortgages are especially likely to contain such terms. Instead, they might require borrowers to roll the savings into the reverse mortgage, and/or take all of the cash upfront. Then again, it’s easy for lenders to manage the risk with reverse mortgages (especially given the majority are FHA-insured), and profits from interest are more than enough to offset lost revenue from lower upfront costs.

A few years ago, a handful of pioneering lenders led the way in cutting their closing costs. While the collapse of the housing bubble spurred a reassessment of risk management practices, many lenders are once again examining how they can be more competitive. Especially since the HECM Saver (which doesn’t carry an upfront insurance premium) was introduced, lenders have little choice but to reduce closing costs if they want to offer a less expensive product.

In short, before committing to a specific lender, make sure you do some research. Even if you have already applied and are waist-deep in the process, it doesn’t hurt to ask your lender for a discount. Remember that until you sign the mortgage contract (and even then you still have a 3-Day Right of Rescission), you are under no obligation to obtain the reverse mortgage. Make sure you take advantage of that freedom to obtain the best terms/rates that are available.

It now seems that the Guidance issued recently by the Federal Financial Institutions Examination Council (FFIEC) was a mere prelude to actual regulatory changes. In August 2010, the Federal Reserve Bank proposed “enhanced consumer protections and disclosures” for reverse mortgages. Now, the 90-day comment period that followed its publication is about to expire, and following some additional revisions, the Fed’s proposals could become tantamount to law.

The Fed’s overarching goal is to improve the disclosures that borrowers receive at various stages throughout the reverse mortgage. (The Fed will also push to strengthen regulations governing the marketing of reverse mortgages, to further limit lenders from cross-selling other financial products in conjunction with reverse mortgages, and to clarify the borrower’s Right to Rescind, but these are all subsumed under the umbrella of disclosure).

Under the proposed changes, prospective borrowers “would receive disclosure on or with the application form, using simple language to highlight the basic features and risks of reverse mortgages.” The purpose of this initial disclosure would be to clarify how reverse mortgages are different from conventional mortgages. After receiving the application, lenders would be required to furnish “transaction-specific disclosures that reflect the actual terms of the reverse mortgage being offered.”

The sample disclosure form prepared by the Fed is both comprehensive and specific. It first lists information about the borrower and property, followed by a basic description of the reverse mortgage, including the borrower’s rights and responsibilities. The next section details the disbursement of funds and informs the borrower that he may change the form of disbursement (from line of credit to monthly advance, for example). This is followed by an explanation of APR, including how it is determined and whether it can change.

Next is a discussion of fees, beginning with origination fees (“Account Opening Fees”), and followed by monthly service fees and any early termination fees. After a brief summary of borrowing guidelines and limits, there is a table that shows how the loan balance will (hypothetically) grow over time. Repayment options are covered, as are the risks. Here, lenders explicate the conditions under which they would cease disbursement of funds, terminate the loan, and/or foreclose on the property. Finally, there is some boiler-plate language stating that the prospective borrower is under no obligation to accept the terms of the reverse mortgage, that he has the right to rescind the loan, and that he should seek counseling before taking further action.

While the fed acknowledges that “disclosures alone may not always be sufficient to protect consumers from unfair practices related to reverse mortgages,” it is nonetheless agreed that better disclosure will at least serve to stop borrowers from obtaining them without fully understanding what they are getting themselves into.

Due to its unique structure, a reverse mortgage can be obtained without any examination of the borrower’s creditworthiness. Instead, lenders will focus on the quality of the home, which serves as collateral for the loan. However, there is evidence that this could soon change, and that lenders could begin conducting credit checks for prospective borrowers.

In fact, it is already the case that proprietary reverse mortgage loans require borrowers to have strong credit. That’s not because proprietary loans are structured differently from FHA-insured Home Equity Conversion Mortgages (HECM), the product of choice for 95% of reverse mortgage borrowers. Instead, lenders merely need confirmation that borrowers have the means to pay property taxes, hazard insurance premiums, and maintain their properties, thereby mitigating any possibility of default.

With HECM reverse mortgages, this is not of primary concern to lenders. To be sure, default/foreclosure is always unfortunate, and it is an undesirable outcome for all parties involved. However, the fact that HECM loans are insured by the FHA means that lenders don’t need to worry about what would happen in the event of default, since any losses will be defrayed by the FHA. With proprietary loans, in contrast, all losses are absorbed directly by lenders, or by investors in reverse mortgage backed securities.

Given that default is inherently undesirable, the reverse mortgage industry is currently brainstorming solutions designed to prevent it from happening. One proposal is that when the reverse mortgage is originated, an escrow account will be created, so that property taxes and hazard insurance premiums can be paid automatically. In fact, escrow accounts are required for many conventional mortgages, and it’s unclear why they were never deemed necessary for reverse mortgages. Another proposal would mirror the steps taken by proprietary lenders. By performing a simple credit check, lenders can quickly screen potential borrowers and reject those that are most likely to default.

This is important if reverse mortgages are to continue their push into the mainstream. With even lower rates of default, reverse mortgages will become even more attractive to investors and better candidates for securitization. That should lead to the lowering of reverse mortgage interest rates and generally more attractive terms for borrowers. One day, proprietary reverse mortgages might even hope to rival HECM reverse mortgages in popularity.

For now, most borrowers can rest assured that their credit history – whether strong or weak – is not a factor in their reverse mortgage application. As for whether this will be the case in the future, well, we will have to wait and see.

The FHA-insured Home Equity Conversion Mortgage (HECM) is the product of choice for the overwhelming majority of reverse mortgage borrowers. However, the current loan maximum for both the HECM standard and HECM Saver is $625,500, which means that those with more expensive homes must utilize Jumbo loans for their reverse mortgage needs.

Jumbo reverse mortgages are a form of proprietary mortgages, and must necessarily be obtained directly from the lender. On the one hand, the absence of FHA insurance premiums eliminates one of the most significant costs for borrowers. On the other hand, this also removes the main safety feature of reverse mortgages, and besides, lenders will always compensate for the lack of insurance by charging a higher interest rate. They will also require a solid credit history, in order to ensure that borrowers have the means to pay taxes and hazard insurance premiums, as well as to maintain the property, after the reverse mortgage has been originated.

Even though proprietary reverse mortgages are not subject to the same standards as HECM reverse mortgages, they are becoming subject to increasingly stringent regulation. A handful of states have already legislated that all reverse mortgages conform to the same set of standards, including that proprietary mortgages must install the same safeguards to minimize the chance of default. Recent federal guidance, while non-binding, was also aimed at bringing proprietary reverse mortgages up to code.

Prior to the housing market crash, most major reverse mortgage lenders also offered a proprietary Jumbo product. As of November 2010, however, Generation Mortgage is the only such lender. Its Generation Plus Loan “targets owners over age 62 with homes appraising between $500,000 and $6 million,” and “carries a fixed rate of 7.78 or 8.78 percent, depending upon the program. All funds must be taken at closing. A minimum FICO score of 700 is required.” As the mortgage industry normalizes and securitization (in the form of Mortgage Backed Securities) becomes viable, the number of lenders offering proprietary reverse mortgage products should increase.

In addition, pending federal legislation would increase the loan limits in certain regions for all FHA borrowers, perhaps as high as $778,000 in the most expensive markets. In that case, a larger chunk of borrowers would become eligible for HECM reverse mortgages. However, given that it was only recently that the FHA’s dire financial circumstances prompted it to consider cutting limits, it seems unlikely that such legislation will be passed anytime soon. In reality, HECM reverse mortgage limits are just as likely to be lowered (to the former level of $417,000, or even lower) as they are to rise.

I recently reported on the Formal Guidance that the Federal Financial Institutions Examination Council (FFIEC) issued on the reverse mortgage industry. With this post, I want to focus on one section of the guidance: “Communications with Consumers.”

One of the main complaints about reverse mortgages is not with the product itself, but rather the way in which it is presented to consumers. Misleading ads claim that reverse mortgages are a government benefit, or that reverse mortgages are free, or that they don’t need to be repaid, or that they are structured in such a way that it is impossible to lose your home.

It seems that some prospective borrowers don’t learn the truth until they are knee-deep in the process and undergo the required counseling session. By this stage, the decision to obtain the reverse mortgage has already been made, which is why the FFIEC has encouraged the reverse mortgage industry to level with consumers, “from the moment a consumer begins shopping for a loan to the time a loan is closed…not just upon the submission of an application or at consummation.”

First, lenders need to make clear to consumers the fees and costs associated with the reverse mortgage, including origination fees, insurance premiums, other upfront third-party fees, interest costs, service fee set aside (“sfsa”), etc. It should be clearly explained that even though the borrower is not required to pay for any of these costs in cash, they are rolled into the reverse mortgage and are subtracted from the borrower’s home equity. Hence, they are not free and unless stated otherwise, they are defrayed directly by the borrower and not by the lender.

Next, lenders have a responsibility to explain the structure of reverse mortgages in a way that demystifies it. For example, borrowers should understand the different types of reverse mortgages available to them, as well as the terms and other features particular to each type. They need to further understand how the principal limits are calculated, “based on home value, borrower age, expected interest rates, and program limitations,” but that they are NOT required to borrow the maximum allowable amount. Lenders, meanwhile, should delineate the different options for disbursement of the reverse mortgage proceeds, including lump-sum payment, line of credit, term, and tenure.

Last and certainly not least, lenders need to clearly outline the risks of reverse mortgages and the obligations of borrowers. Most important are the conditions that would trigger a default, such as failure to pay taxes and hazard insurance, inability to maintain the property, or moving out. The borrower should understand unequivocally that the reverse mortgage must be repaid, as well as the process for doing so.

If all of the above guidelines are followed, accusations of false marketing would all but disappear. While some critics will continue to harp on the inappropriateness of reverse mortgages, at least they will have no cause to be angry with lenders. Borrowers will be able to make informed decisions, and those that regret their choice will sadly have only themselves to blame.

Last year, I offered a primer on Selecting a Reverse Mortgage Interest Rate. I want to update that post below, in accordance with the unveiling of the new HECM Saver, which differs from the existing HECM Standard in that it waives the upfront Insurance Premium in exchanging for lending smaller amounts to reverse mortgage borrowers.

The basic difference between fixed rates and variable rates is that the former stay the same throughout the life of the reverse mortgage, while the latter fluctuate. In a nutshell, the advantage of choosing a fixed rate is that it is stable and predictable, while a variable rate might offer the possibility of either short-term or long-term savings. As fixed rates are presently much higher than variable rates, you can think of a fixed-rate as a kind of security premium that you pay for not having to worry about rising interest rates.

It’s important to be aware that with a fixed-rate reverse mortgage, you will probably be required to receive the entire loan as an upfront payout. (That’s not to say that you can’t select a variable rate and an upfront payout). If you are determined to receive a line of credit or tenure/term monthly payments, you must accept a variable interest rate and the accompanying uncertainty.

As of November 2010, a fixed-rate HECM Standard can be obtained for 4.99%, while an HECM Saver can be obtained for 5.25%. (While conventional mortgage fixed-rates are slightly lower, a rate floor is dictated the FHA). Variable rates follow the same relationship; lenders might use the same benchmark interest rate (1-month LIBOR or a short-term Treasury rate), but will typically add a greater margin onto HECM Saver loans. Currently, an HECM Standard carries a variable rate of 2.5%, while an HECM Saver will carry a variable rate closer to 3%.

Regardless of whether you choose a fixed-rate or variable rate, any savings from not having to pay an upfront insurance premium (with the HECM Saver) might be offset by a higher interest rate. To make matter even more confusing, unused funds (if you select the line-of-credit payout option) will pay you interest at a higher rate with an HECM Saver, compared to an HECM Standard.

In short, choosing between a Saver and a Standard depends on how you withdraw the proceeds of the reverse mortgage and the planned duration of your reverse mortgage. The same is largely true when comparing fixed rates and variable rates. If you have a short time horizon, you will probably save money with a variable-rate HECM Saver. Since interest rates will probably rise within the next five years, however, those that plan to maintain the reverse mortgage indefinitely will probably come out ahead with a fixed-rate HECM Standard.

This is a question that many prospective borrowers ask themselves, once they have made the tentative decision to obtain a reverse mortgage: should they work directly with a lender or go through a borrower?

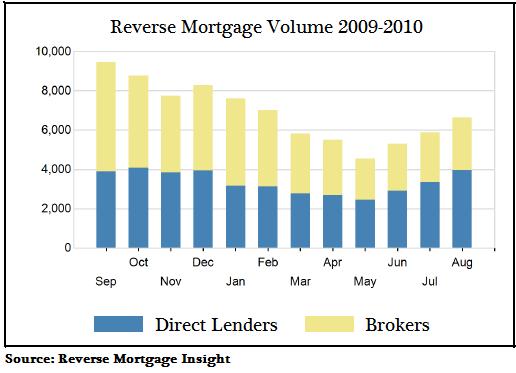

Based on the most recent data, more borrowers are choosing to engage directly with lenders. In August 2010, 60% of reverse mortgages were originated by lenders, compared to only 40% in August in 2009. If you slice the data another way, lenders originated 18% more reverse mortgages – compared to 2009 – while broker loan volume grew by only 6%.

It’s difficult to say for sure what’s driving this trend away from brokers. Their reputation was damaged by the report from the National Consumer Law Center that compared reverse mortgages to subprime mortgages. Brokers were singled out by the report for using unscrupulous practices to enhance their commissions. For example, they have been known to steer reverse mortgage borrowers into inappropriate financial products, such as annuities.

It could also be that changes in reverse mortgage pricing, such as the elimination of origination fees and the service-fee-set-aside (sfsa) and partially subsidized insurance premiums, are making it difficult for brokers to compete, since they can’t offer borrowers such attractive terms. Their lack of competitiveness has been further exacerbated by laws forbidding hidden yield-spread-premiums, which mean that they must earn their commissions directly from the borrower, instead of from the lender.

Since many brokers cannot compete on price, they have taken to selling their expertise and their ability to provide unbiased advice. While there is something to be said for the fact that they don’t have the same financial interest as lenders in originating loans, they still only get paid if elect to obtain a reverse mortgage. In practice, then, they are probably just as biased in lenders when explaining the pros and cons of reverse mortgages.

Finally, given that most lenders offer identical reverse mortgages (that conform to FHA government standards), there probably isn’t much value in advice which purports to help you differentiate one lender from another. In short, the case for using a reverse mortgage broker – as opposed to a direct lender – is looking pretty weak at the moment.

Reverse Mortgages are often billed by lenders as being 100% safe. Since they are insured by the FHA and because they are non-recourse loans, there is no risk of you ever owing the lender money, even if your reverse mortgage is underwater. If you read the fine print, though, you will see that it is still possible to default on your reverse mortgage.

Most reverse mortgages are canceled only when the last remaining borrower passes away or moves out, or when the borrower voluntarily chooses to repay the loan. However, if you fail to pay property taxes and/or fail to maintain the home, you are in violation of the the terms of the loan agreement, and the lender is entitled to cancel the reverse mortgage. This is because a tax lien supersedes the reverse mortgage lien, which means that when the home is sold, the government has priority over the lender in collecting on any debts.

If you are found to be in default, the lender will immediately cut off any unused portion of your line of credit and/or stop remitting monthly payments to you if you elected to receive your reverse mortgage disbursement as term/tenure payments. After giving you a chance to rectify the situation, it may then apply with the local court to foreclosure on your property, and if approved, the property will be sold. Any leftover proceeds from the sale (after the reverse mortgage is repaid and money is set aside for unpaid taxes and maintenance costs) will be distributed to the borrower. Of course, the borrower’s credit will be shattered, and it will be difficult to obtain another loan.

Unfortunately, default is an issue that affects a significant portion of reverse mortgage borrowers – perhaps as many as 30,000. That’s because many borrowers receive the loan proceeds as a lump-sum payment, which is then used to repay debt (such as an existing mortgage) or spent quickly. Such borrowers often fail to set aside enough cash to pay property taxes and maintain the property, and/or are gripped by financial hardship.

In early 2010, the FHA encouraged lenders to foreclose on properties whose reverse mortgages were in default. At the time, the FHA was dealing with financial hardship of its own, and was rumored to be seeking a government bailout. However, it seems that the majority of lenders are still reluctant to foreclose (because of the bad press that it would generate) are awaiting further guidance from the Department of Housing and Urban Development (HUD), which should be released in 2011. There is technically an emergency loan program that is designed to help borrowers whose loans are in default, but only those who are temporarily unemployed are eligible. In short, those that are currently in default can only sit tight and wait.

According to the most recent statistics, 20% of conventional mortgages in the US are now underwater, which means that the loan balance exceeds the value of the home. While comparable figures for reverse mortgages are not available, it stands to reason that a similar proportion of reverse mortgage borrowers are in the same position. Before you start to worry about whether your reverse mortgage is affected by such a condition, there are a few things that you should know.

First of all, all HECM reverse mortgages are no-recourse loans and are insured by the Federal Housing Administration (FHA). That means that if the proceeds from the sale of your home are not enough to repay the balance of the reverse mortgage, your lender is contractually prevented from seeking the difference from you or your estate/heirs. Instead, the FHA will reimburse the lender using funds from the insurance pool. As a result, it is IMPOSSIBLE that you will ever end up owing your lender more than what you borrowed, regardless of what happens to the value of your home in the interim. (Note that this is not necessarily the case with a conventional mortgage).

Second, your lender is permitted neither to alter the terms of the loan nor the size of the loan after the reverse mortgage is originated. If you elected to receive a line-of-credit for $XX or a tenure monthly payment of $XX for the rest of your life, your lender is contractually obligated to honor this commitment for as long as the reverse mortgage remains outstanding (until the borrower passes away, sells the home, or moves out). Even if the value of the home declines to the point that the reverse mortgage is well underwater, the lender is not allowed to cancel or reduce any proceeds that you have yet to receive.

Only if you breach the terms of the contract can the lender freeze the payout of any unclaimed proceeds. That begs the question of whether you should deliberately withdraw any remaining funds in order to guard against such a possibility. For example, if the primary borrower were to pass away tomorrow, the unused portion of any credit line would be immediately frozen. If the home has appreciated in value, then any leftover proceeds will be distributed to the borrower’s estate following the sale of the home. If the home has depreciated significantly, however, then the borrowers’ heirs will receive nothing.

By preemptively withdrawing all unused funds if your reverse mortgage is underwater, you would effectively eliminate this as a possibility. This doesn’t mean that you have to spend this money immediately; rather, you could simply transfer the funds from your reverse mortgage line of credit to a savings account with another bank. The only downside is that these funds will probably accrue interest at a lower rate than your line of credit, which would otherwise grow every year by your reverse mortgage interest rate.

While all of this is bad news for taxpayers (and perhaps future reverse mortgage borrowers), it shouldn’t affect your approach to managing your reverse mortgage. When you initially obtained the loan, its (maximum) size was determined by (among other factors) the appraised value of your home at that time. Regardless of what your home is worth now, or in the future, you are entitled to every cent that the lender promised you and is printed in the loan agreement.