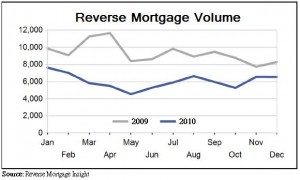

According to Reverse Mortgage Insight, the reverse mortgage lending seems to be caught in a downward spiral. On a year-over-year basis, volume is now declining at a precipitous pace. If there is any silver lining, however, it is is that the number of reverse mortgage lenders also seems to be dwindling, such that those lenders that have survived have actually experienced an increase in business.

Overall, total reverse mortgage volume fell 35% to 72,748 in 2010, compared to 111,924 endorsements in 2009. This marked the second consecutive year of decline, and worryingly, a quickening of the pace. It’s difficult to explain this trend. After all, the tightening of lending standards that have plagued conventional mortgage lending wouldn’t be expected impact reverse mortgage lending. Given the financial crisis, you would think that volume would be rising, not falling.

Perhaps the decline is being driven by a drop in home prices, and a proportional decrease in home equity. According to a January 2011 New York Fed research report (Household Debt and Saving during the 2007 Recession), “When home prices began to fall in 2007, owners’ equity in household real estate began to fall rapidly from almost $13.5 trillion in 1Q 2006 to a little under $5.3 trillion in 1Q 2009, a decline in total home equity of over 60%. At the end of 2009 owner’s equity was estimated at $6.3 trillion, still more than 50% below its 2006 peak.”

This decline in home equity has rendered a large proportion of potential borrowers – those that couldn’t borrow enough to repay their primary mortgages – completely ineligible for reverse mortgages. It has also made reverse mortgages less attractive for other potential borrowers, by making it less likely that they could borrow enough to offset the high upfront costs.

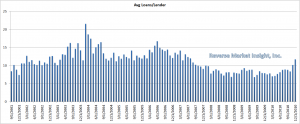

On the bright side, the number of active reverse mortgage lenders fell 29% in 2010, to 2,222. According to Reverse mortgage Insight (Don’t ask me about the math…), that has lifted the average number of loan endorsements per lender to 11.7, the highest level since 2007, and a more than 50% increase from 2009. In fact, 6 out of the top 10 lenders recorded an increase in volume in 2010. Due to Bank of America’s just-announced exit from the reverse mortgage industry, this trend is expected to continue in 2010. (BofA was the second largest reverse mortgage lender by volume, behind only Wells Fargo).

As for how the industry overall will fare in 2011, I think that depends largely on the housing market. Unfortunately, most housing analysts think that prices will either stagnate or continue to fall for the next couple years, which is probably a bad omen for reverse mortgage lending.

One Response to “Reverse Mortgage Volume is Declining”

Have Feedback on This Article?

October 8th, 2011 at 10:55 am

I have been a reverse mortgage lender in Los Angeles since 2005, and I have noticed a sharp decline in volume since 2009. I find that many prospective clients who call me no longer qualify because they do not have enough equity in their homes given the sharp decline in home prices in the California area.