Retirement Account? Check! Social Security Payments? Check! Pension? Check! Investment Portfolio? Check! Savings Account? Check! Real Estate? Check! Credit card? Check! Reverse Mortgage?

I would like to follow up on my post last week (“Financial Planners Don’t Understand Reverse Mortgages“) and ponder an interesting question: Does debt, specifically in the form of a reverse mortgage, deserve a place in your retirement planning? When a homeowner makes the transition into retirement, is it worth pondering a reverse mortgage as part of an overall retirement “strategy.” If so, under what circumstances, if any, would a reverse mortgage be justified?

For the record, I’m not a financial planner, and I’m about to offer specific tips on investing one’s retirement savings.That is something only a real financial planner or investment adviser can do. Still, it’s reasonable to say that as one ages, one’s financial planning should aim to become less risky and more conservative. That means moving from stocks to bonds to cash, moving from illiquid investments into liquid assets that can be drawn from immediately if necessary. That also usually means eliminating debt.

In this context, reverse mortgages would appear to have a contradictory role. On the one hand, they are the epitome of liquidity; after being issued, they can be drawn from until the lending limit is breached. On the other hand, it represents debt, and most financial planners advise retiring borrowers to eliminate debt as they move into retirement. At the same time, a reverse mortgage is different from conventional debt since it is repaid through the sale of the property and not in periodic installments. In addition, if used to phase out a conventional mortgage, it can have the effect of eliminating debt in the practical sense. (To be fair, in the actual sense, one form of debt is actually being swapped for another).

It’s fair to say that for those that own their homes outright, have stable sources of income (from social security, pension, etc., if not from actual work), and healthy personal balance sheets (assets well exceed liabilities), a reverse mortgage isn’t necessary. Sure, it would be nice to monetize one’s home and have access to a line of credit, but a price is paid (in the form of origination fees, insurance premiums and eventually, interest payments) for this luxury. Since reverse mortgages can be usually be processed quickly – they don’t require the credit checks and documentation of conventional mortgages – it’s probably better to wait until your financial position and lifestyle preferences actually necessitate obtaining one.

For those of you that don’t own you homes outright and lack the wherewithal to repay their primary mortgages, you could consider obtaining a reverse mortgage. This would serve to eliminate debt (aka risk) and to free up cash/income that you had otherwise used to make mortgage payments. For those that own their homes (and don’t want to move!) but have weak financial positions, a reverse mortgage would buttress your monthly income, if taken in installments.

For all borrowers, the proceeds from a reverse mortgage should only be used for home, living, healthcare, and related expenses. They shouldn’t be obtained with the intention of investing the proceeds in other financial products, such as stocks, bonds, annuities, etc, and to supplement other, existing sources of income.

By their very nature, reverse mortgages are designed to remain outstanding until the death of the last remaining borrower. This raises a couple important questions: how is this debt repaid, and what obligations, if any, are assumed by the borrowers’ heirs?

Reverse mortgage lenders certainly don’t make this issue easy to understand, since some claim that the debt is transferred to the borrowers’ heirs upon death, but others advertise that the slate is wiped clean and hence, there is no risk that the heirs would be on the hook for any unpaid debt. As it turns out, they are both right.

Since a reverse mortgage is a loan agreement, of course it must be repaid. In most cases, the property that serves as collateral for the reverse mortgage is simply sold upon the death of the borrower, and the proceeds from the sale are used to repay the loan. Any leftover cash reverts to the borrower’s estate and will be distributed accordingly. If the sale of the property does not generate enough proceeds to repay the loan, the FHA – assuming the reverse mortgage was a Home Equity Conversion Mortgage (HECM) – is on the hook for the difference – not the borrower and certainly not his estate. It is because of this FHA insurance, that neither the borrower nor his heirs bear an risk from property depreciation (unlike with a conventional mortgage) when obtaining a reverse mortgage. [If the reverse mortgage was an insured private loan, the above doesn’t apply].

The problem of repaying the loan naturally becomes more complex if the borrower’s heirs (or the borrower himself, if the reverse mortgage was called while he was still alive) wish to keep the property, rather than selling it to repay the loan. In this case, it is incumbent upon them to generate cash from other sources (savings, investments, or conventional mortgage). Typically, there is a 12-month grace period afforded by the lender during which time the borrower and his heirs must sort out the repayment of the loan. During this time, the reverse mortgage remains outstanding and will continue to accrue interest.

When viewed from this perspective, it’s easy to see how the borrowers’ heirs could become responsible for repaying the reverse mortgage. Still, I think the distinction between voluntarily repaying the loan (due to a desire to keep the property) and assuming a legal obligation to do so.

While reverse mortgages seemed to have attracted at least grudging acceptance from the rest of the population, they have yet to receive an endorsement from one crucial segment: financial planners. Due to a combination of misunderstanding, lack of expertise, and knee-jerk aversion, it seems that financial advisers and their ilk are reluctant to recommend reverse mortgages to their clients. Let’s explore this issue in greater detail.

Many Americans are effectively house-rich and cash-poor, which means that the majority of their wealth exists in the form of home equity, while other savings and assets are minimal. This phenomenon was exacerbated by the financial crisis, which devastated investment portfolios and retirement accounts across-the-board. This problem is especially acute for borrowers nearing retirement, because they will need to start drawing on these funds soon, whereas younger borrowers still have time for their investments to recover.

Anecdotally, it seems that financial planners were caught unawares by this scenario: “On the whole, advisers should have seen this coming and should have been adopting a more holistic financial plan for consumers where the family home and the retirement options were included. Cash flow, not asset wealth, is the problem many retirees are now facing and this is a result of having a financial plan that does not look at the whole picture,” said one critic. Many clients are now at the point where piecemeal solutions probably aren’t appropriate.

While reverse mortgages would seem to represent a solution to the house-rich / cash-poor problem, financial planners are loathe to recommend the product. Because the product is still somewhat niche, there has not been a big push to educate those not directly involved in the industry. Those with the strongest understanding of reverse mortgage are naturally the brokers/lenders and the HUD-approved counselors. Having not been told otherwise, financial advisers see reverse mortgages as a negatively-amortizing variable-rate loan that gradually erodes one home equity, and understandably tell their clients to steer clear.

Unfortunately, they don’t seem to realize that for borrowers that are determined to remain in their homes but lack the cash to do so, there are very few other viable solutions. “Financial advisers have been missing in action from retirement planning and this attitude needs to change. By leaving out the family home in the majority of financial plans, advisers have ignored 70 per cent of an individual’s wealth,” summarized one industry insider.

For this to change, the industry itself needs to educate financial planners in both the benefits and drawbacks of reverse mortgages. Certainly, reverse mortgages do entail some risk, and involve substantial costs; these concerns can and should be factored into the decision. However, financial planners that wish to fulfill their fiduciary duties to their clients should take the time to at least make them aware that the option exists. While the result might not necessarily be a boon for the industry, it will at least serve to eliminate misconceptions and help advisers to help their clients make informed decisions about managing their finances.

When deciding whether to obtain a reverse mortgage, there is one (if not many) important question that often gets overlooked: is it practical/affordable for the borrower(s) to continue living at home? In other words, before you can even think about reverse mortgaging your property, you must consider whether the property is even suitable for you. Actually, it’s not enough to merely address current suitability; one must also consider future suitability. You are probably in excellent health now. At some point in the unforeseeable future, however, you probably won’t be. While this possibility may seem very distant, you may regret not taking it into account if circumstances change after you receive your reverse mortgage.

This issue is explored in detail by the National Council on Ageing (NCOA) Reverse Mortgage Booklet. According to NCOA, there are four factors that should be taken into consideration: changing needs, safety, ease of use, and isolation. The first three factors refer to the home itself. Is it uncluttered and well laid-out, from the standpoint of an elderly person (i.e. the future YOU). Is it handicap accessible, or can it at least be made handicap-accessible? Will the home require significant upkeep/repairs? The final factor – isolation – refers to location. Is the home conveniently located, from the standpoint of an elderly/handicapped person? Is it possible to get around and run errands without the use of a car? Is the location such that you would be worried about the prospect of becoming lonely?

Next, you need to consider how you can obtain outside help if need be. Again, this might be a difficult notion to fathom in your current (healthy) state, but at least give it a thought. Will you be able to afford the cost of outside care, such as a home health aid? If not, perhaps you should account for this in your reverse mortgage budget. Otherwise, you need to ask yourself whether you can depend on “non-remunerative” care, whether from family, friends, charitable organizations, etc. What will you do when you can no longer care for yourself? Will you move into an independent/assisted living facility? If so, how will you pay for this, given that you may have depleted a significant portion of your home equity (from the reverse mortgage) in the mean time?

Not only do you need to determine whether it’s practical for you to remain in your home (for at least the 5-10 years that is required to make a reverse mortgage economical), but you must also determine whether it’s affordable. Ask yourself how your reverse mortgage will impact your future finances, especially at the point at which you can no longer take care of yourself. If you spend all of the proceeds on the reverse mortgage now, what will you do after your health declines and you need to seek outside help? In short, it’s essential that you be as financially far-sighted as possible when deciding whether to obtain a reverse mortgage today.

As part of obtaining a reverse mortgage, every (potential) borrower is required to undergo a counseling session with a HUD-approved agency. Among other things, counselors are required to provide participants with a copy of the National Counsel on Ageing (NCOA) reverse mortgage handbook. As it turns out, this booklet is a great resource, and should be read by all borrowers. Why wait until you’re already knee-deep in the application process – at which point the counseling session is a mere formality? Why not read it now?!

According to the NCOA, the decision to obtain a reverse mortgage actually involves two separate decisions:

1) Is it right to stay in your home (as opposed to moving into a smaller home or into a Continuing Care Retirement Community [CCRC])?

2) If you can’t afford to stay in your home, what is the best way to obtain assistance/financing?

According to NCOA, the former decision is actually more difficult. One must decide whether the existing home is a suitable place to age, especially given that your health will probably be in a gradual, but continuous state of decline. If you already have serious health problems, then this issue is already of pressing importance. You should consider both the home itself, as well its location. If you become handicapped, will you be able to continue to live there? If you can’t drive, will you still be able to take care of yourself? [These questions are so weighty that I think I will devote my next post just to helping potential borrowers sort through this issue].

Then, there are the financial considerations. If you’ve decided that you want to remain in your home, can you afford to do so currently? Could you afford to do so if you health deteriorated and/or you require additional help. The brochure provides readers with some average cost figures, designed to help them budget for this latter possibility. Before obtaining financing/assistance of any kind, the NCOA recommends that readers draw up detailed budgets, taking both current household and (future) medical expenses into account. At this point, they can begin to estimate how much cash they will require if they are to continue living in the same home.

Borrowers are advised to first look at their own personal financial situation before seeking outside help. The booklet then lays out all of the loan options available to borrowers, along with the advantages and disadvantages of each one. There are home equity loans, single-purpose reverse mortgages, and Home Equity Conversion Mortgages (HECM), all of which are given equal space.

It is unfortunate that the majority of those who are provided with this pamphlet will have already made the decision to obtain a reverse mortgage prior to reading it. Do yourself a favor, and get educated before you begin the process.

At the end of last month, US News and a handful of other media outlets reported that the FHA was in the final stages of releasing a new reverse product. Known as the HECM “Saver,” the new product would be cheaper than its predecessor, but would be offset by smaller principal limits. The news was roundly met with enthusiasm and support.

The only problem is that neither HUD nor its subsidiary FHA ever formally announced any plans for the HECM Saver. The same goes for the National Reverse Mortgage Lenders Association (NRMLA), to which some of the rumors have been falsely attributed. To be sure, representatives from government agencies and private industry have discussed the possibility of such a product from time to time, but it remains in gestation.

Media excitement over the HECM Saver is understandable. One of the main criticisms of the existing HECM reverse mortgage is that it is too expensive. However, the FHA fairly points out that the insurance premiums which make the product expensive are necessary to offset the risk of home-price depreciation and ultimately, default. Thus, the upfront mortgage insurance premium will be a token .01% of the loan amount, with an annual insurance premium of 1.25%. However, HECM borrowers can expect to receive 10-18% less than borrowers who use the conventional HECM. It is intended that HECM Saver borrowers will withdraw all of the proceeds upfront and that interest will accrue at a fixed rate.

Speaking of which, this product will be renamed the HECM Standard and will be revamped slightly. The upfront mortgage insurance premium will be 2%, and the annual premium is slated to rise from .5% to 1.25%. Principal limits will probably remain at current levels (having been slashed already), and interest rates might be higher to compensate for the added risk.

By segmenting the HECM into two different products, the FHA is effectively acknowledging that there is a much higher risk associated with allowing borrowers to borrow against larger proportions of home equity. Since the mortgages are secured by the properties, as long as one’s home equity remains positive, the lender assumes no risk. With larger loans, however, the possibility of a reverse mortgage depreciating into negative equity territory (and consequently, foreclosure) is much higher, a risk that should be reflected in the terms of the loan.

It’s unclear when the HECM Saver will be released, but when it does, it will be probably be marked by a large-scale roll-out by lenders. According to the HUD website, “Changes to support Sponsored Originators, Loan Officers, and HECM Saver” are scheduled to be implemented on October 4, 2010. We’ll keep you posted.

Before you begin the process of applying for a reverse mortgage, it’s important to determine whether or not your property is eligible. Even if you are like the majority of reverse mortgage borrowers and live in a single family, one-unit home, you still need to go through the same process of qualifying.

First and foremost, the property that you wish to mortgage must be your primary residence. That means that you reside in this property (almost) exclusively and that it is not a second home or vacation home. In addition, it must be fully completed and occupied, with a certificate of occupancy or equivalent as proof. Manufacture homes built prior to 1975 are not eligible, while newer manufactured homes must conform to modern safety standards and stand atop a foundation in order to qualify. Boarding houses, Bed & Breakfasts, and Cooperatively Owned Units (Co-ops) are ineligible, as are properties that contain more than four units.

After you obtain the reverse mortgage, the property must remain your primary residence. If you permanently move out of the property (typically defined as leaving for more than one year), the reverse mortgage will be called by the lender, who may choose to initiate foreclosure proceedings. While the reverse mortgage is outstanding, renting the property is considered a breach of contract and will also lead the mortgage being called. In short, primary residence means primary residence. No exceptions.

Understandably, reverse mortgage lenders are less inclined to take on added risk for mortgages that will stay on their own books. That means that for properties in question (i.e. certain manufactured homes), most lenders will try to qualify you using the HECM reverse mortgage (which is probably just as well) than for any proprietary reverse mortgage products that they offer.

If you are still in doubt as to whether your property is eligible, contact a reverse mortgage lender near you.

On August 16, the The Federal Financial Institutions Examination Council (FFIEC) [an organization which includes the Office of the Comptroller of the Currency, the Federal Reserve, the Federal Deposit Insurance Corp., the Office of Thrift Supervision, the National Credit Union Administration, and the State Liaison Committee] formally issued guidance to the reverse mortgage industry. The guidance is not in fact legally binding, and in fact, it mentioned the handful of existing laws which already govern reverse mortgages. Rather, its purpose was “to address compliance and reputation risks associated with reverse mortgages…Institutions are expected to use the guidance in their efforts to ensure that their risk management and consumer protection practices adequately address the compliance and reputation risks raised by reverse mortgage lending.”

The FFIEC identified four overarching concerns:

1) Misleading advertisements and a related lack of borrower understanding of the “costs, terms, risks, and other consequences” of reverse mortgages. Borrower misinformation is still a serious problem, and lenders deserve some of the blame. For example, some lenders continue to perpetrate the myth that a reverse mortgage is “riskless” and/or a government benefit.

2) Inadequate or Biased Counseling. It is problematic that certain counselors might have ties to particular lenders, and that other counselors do not adequately address suitable alternatives to reverse mortgages and the complete financial and legal implications of obtaining a reverse mortgage.

3) Lender Failure to Guarantee the payment of Taxes and Homeowners Insurance. Perhaps the lenders should take it upon themselves to ensure payment, since failure to do so could result in foreclosure.

4) Potential conflicts of interest that may create incentives to cross-sell ancillary investment and insurance products. While this has already been banned by existing legislation, it’s important for lenders to be reminded to always avoid the appearance of impropriety,

Based on these issue, the FFIEC formulated a handful of guidelines. With regard to misleading advertisements, it encouraged the use of “promotional materials and other product descriptions that provide information about the costs, terms, features, and risks of reverse mortgage products.” It should include information about “borrower and property eligibility,” determination of principal limits, payout option, the conditions that would cause foreclosure, fees, and hopefully, alternatives to reverse mortgages. In order to minimize the possibility of foreclosure, lenders are encouraged to either set up escrow accounts for the payment of property taxes and homeowners insurance, or issue stern reminders to borrowers of the importance of making such payments.

Counselors, meanwhile, are charged with informing borrowers primarily of “the availability of other housing, social service, health, and financial options…other than reverse mortgages, including other mortgage products, sale-leaseback financing, and deferred payment loans.” Counselors should also explain “the differences between HECM loans and proprietary reverse mortgages, the financial implications and tax consequences of entering into a reverse mortgage, the impact of a reverse mortgage on eligibility for federal and state needs-based assistance programs, including Supplemental Security Income, and the impact of the reverse mortgage on the estate and heirs.” Finally, lenders themselves need to make sure that they have strong “written policies and internal controls,” in order to avoid the arising of any conflicts of interest.

Overall, I think the FFIEC hit the nail right on the head. It identified all of the main concerns regarding reverse mortgages without denigrating their appeal or unnecessarily vilifying the industry. The solutions that it proposed or both practical and reasonable, and serve to limit deception, cross-selling, and foreclosure. If these reforms are implemented, I think that both borrower suitability and satisfaction will increase.

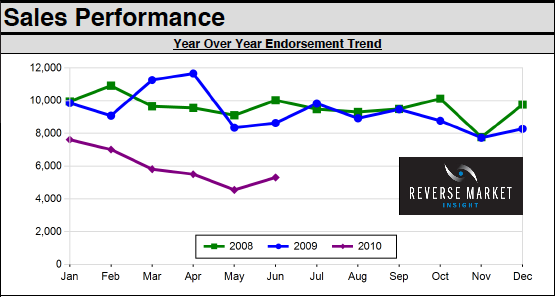

In early August, I reported that reverse mortgage volume is significantly lower in 2010, and in fact, has been falling steadily for the last two years. I explained that due to falling home prices, less attractive FHA lending guidelines, and a general image problem, demand for reverse mortgages is understandably low at the moment. Over the long-term, however, I think that demographic drivers will ensure that the market for reverse mortgage loans remains large.

First of all, there is the retiring baby boom. According to the Census Bureau, the boom began in 1946 (right after the end of World War II), in which case the first round of retired baby boomers is already eligible (i.e. was 62 years of age) to obtain reverse mortgages. As the demographic pyramid gradually inverts (or at least flattens) over the next 20 years, the pool of borrowers eligible for reverse mortgages will be larger than at any time since the product was introduced.

In addition, surveys and anecdotal reports suggest that this generation is both more comfortable with debt than previous generations, and is accustomed to taking out debt in order to support a higher – some would say unsustainable – standard of living. Moreover, the financial crisis was like a 1-2 punch: it devastated retirement accounts and then forced many middle-aged Americans into early retirement. For those that want to remain in their current homes and maintain their existing standard of living, obtaining a reverse mortgage might now be the only realistic option.

In addition, the reverse mortgage industry has taken steps to fix its image problem. It has supported (grudgingly) legislation that banned cross-selling of annuities and other insurance products, and put into place safeguards for borrowers, including a more rigorous HUD-mandated counseling session. Many lenders have also cut their origination fees and/or offered to subsidize FHA insurance premiums for borrowers, which is appropriate since lenders bear zero risk from the reverse mortgages they originate. On the other hand, there is a growing awareness that reverse mortgages are not appropriate for all borrowers, namely those with short-time frames, health problems, and cheaper sources of cash. For this reason, many financial planners are still reluctant to advise their clients to obtain reverse mortgages.

In conclusion, there is reason to believe that demand for reverse mortgages will rebound, especially if the housing market recovers. On the other hand, earlier forecasts for an explosion in the market are unlikely to materialize, and the reverse mortgage will probably remain a niche product for the foreseeable future.