Those of you who regularly read this blog are probably surprised to see such a title. After all, this blog purports to be an advocate for consumers (i.e. potential borrowers), rather than lenders. As a result, many of my posts are mildly critical of reverse mortgages. In the end, however, I like to think of myself as an unbiased quasi-journalist., and I simply call it like I see it.

On that note, I think concerns over reverse mortgage fraud are overblown. With the recent release of the FBI’s annual Mortgage Fraud Report, analysts are attacking reverse mortgages with renewed vigor, and simply rallying around fraud as an obvious focal point.

To be sure, mortgage fraud is real and it is abhorrent. According to the report:

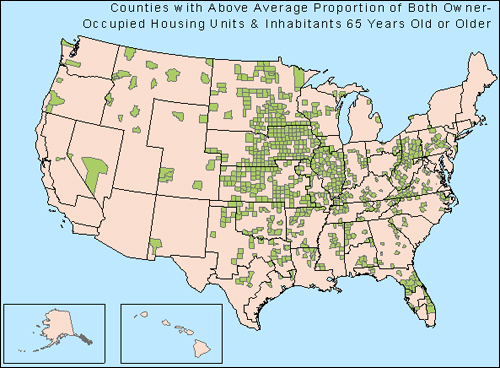

Perpetrators recruit seniors through local churches, investment seminars, and television, radio, billboard, and mailer advertisements and commit the fraud primarily through equity theft, foreclosure rescue, and investment schemes. HECM-related fraud is occurring in every region of the United States, and reverse mortgage schemes have the potential to increase substantially as demand for these products rises in demographically dense senior citizen jurisdictions.

It is frequently pointed out that due both to the demographics of borrowers and the very nature of the product, fraud is especially rife in reverse mortgage lending. There is certainly some truth to this, as it has been established that seniors are comparatively susceptible to being deceived and are less likely to report such deception. In addition, since reverse mortgages don’t require one to spend any money (all fees are rolled in), borrowers are perhaps more apt to let their guard down, since upon closing, they will still finish with money in their respective pockets.

At the same time, however, fraud is a risk in all manner of commercial transactions, and reverse mortgage are hardly unique in this regard. I’m not apologizing for reverse mortgage fraud; on the contrary, I denounce it and think that borrowers should be vigilant in preventing it, and law enforcement agencies should be strict in prosecuting it. At the same time, there is no indication that fraud is any more prevalent (the FBI’s report doesn’t offer any figures) among reverse mortgages than it is in conventional mortgages.

To illustrate this point further, I recently came across two articles that purported to blow the whistle on reverse mortgage fraud. Upon closer inspection, however, it appears that the first (“Mortgage Fraud: A Classic Crime’s Latest Twist“) article was actually a case of title fraud, while the second (“New Scam Targets Elderly Homeowners with Reverse Mortgages“) profiled a new scam that is neither explicitly fraudulent nor explicitly connected with reverse mortgages. In short, naysayers are basically firing blanks in their collective quest to unearth widespread reverse mortgage fraud.

From the standpoint of borrowers, reverse mortgage fraud is not necessarily easy to identify, but it is pretty easy to avoid. As a general rule, you should avoid solicitations. If you decide, against your better judgment, to respond to a solicitation, make sure that the lender is licensed to make reverse mortgage loans in your state. If you are starting from scratch, you can browse our directory and/or or locate a lender through the National Reverse Mortgage Loan Association (NRMLA), which vouches that all of its members are “licensed to originate reverse mortgages in the states in which they are listed and have signed NRMLA’s Code of Conduct.” Finally, remember that before singing a reverse mortgage loan agreement, you are not only entitled to, but are required to undergo a government-sanctioned counseling session. If your loan has any hint of being a scam, it should be exposed at this stage.

2 Responses to “Reverse Mortgage Fraud Concerns are Overblown”

Have Feedback on This Article?

September 18th, 2010 at 4:53 pm

I WAS ALMORT ROBBED LEGALLY BY REVERSE ONE PREDATORY LENDER WHO WERE GOING TO CHARGE ME OVER $ 8,000.00

MORE THAN OTHER LENDERS CHARGE AND DELAYS ALMOST CAUSED ME TO LOSE MY HOME THANK GOD I CANCELLED PLEASE ALERT ALL SENIRS NOT TO CALLL REVERSE ONE

WINKLERS WORREIED LOOK TELLS THE SCAM

September 18th, 2010 at 4:58 pm

REVERSE ONE MORTGAGE COMPANY

A QUICKEN LOAN COMPANY IS

CROOKED AND A SCAMMER ROBBEING FAMILYS OF OVER $ 8,000.00!! ALSO THEY ‘fix” the lending process also

THEY CONSPIRE WITH REAL ESTATE SHARKS AGAINST ELDERLY

OTHER COMPAMIES DO NOT CHARGE THIS GREEDY ROBBERY FEE!!!

RED ALERT REVERSE ONE IS PREDATORY LENDER

AARP SHOULD ALEERT XENIORS OF THIS COMPANYS SCAM