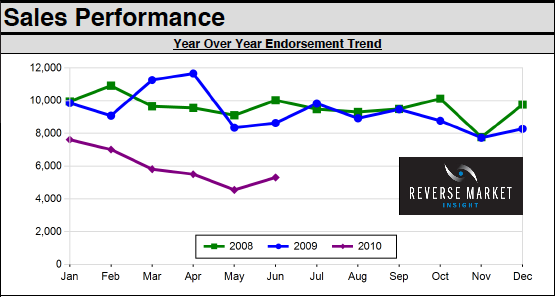

In early August, I reported that reverse mortgage volume is significantly lower in 2010, and in fact, has been falling steadily for the last two years. I explained that due to falling home prices, less attractive FHA lending guidelines, and a general image problem, demand for reverse mortgages is understandably low at the moment. Over the long-term, however, I think that demographic drivers will ensure that the market for reverse mortgage loans remains large.

First of all, there is the retiring baby boom. According to the Census Bureau, the boom began in 1946 (right after the end of World War II), in which case the first round of retired baby boomers is already eligible (i.e. was 62 years of age) to obtain reverse mortgages. As the demographic pyramid gradually inverts (or at least flattens) over the next 20 years, the pool of borrowers eligible for reverse mortgages will be larger than at any time since the product was introduced.

In addition, surveys and anecdotal reports suggest that this generation is both more comfortable with debt than previous generations, and is accustomed to taking out debt in order to support a higher – some would say unsustainable – standard of living. Moreover, the financial crisis was like a 1-2 punch: it devastated retirement accounts and then forced many middle-aged Americans into early retirement. For those that want to remain in their current homes and maintain their existing standard of living, obtaining a reverse mortgage might now be the only realistic option.

In addition, the reverse mortgage industry has taken steps to fix its image problem. It has supported (grudgingly) legislation that banned cross-selling of annuities and other insurance products, and put into place safeguards for borrowers, including a more rigorous HUD-mandated counseling session. Many lenders have also cut their origination fees and/or offered to subsidize FHA insurance premiums for borrowers, which is appropriate since lenders bear zero risk from the reverse mortgages they originate. On the other hand, there is a growing awareness that reverse mortgages are not appropriate for all borrowers, namely those with short-time frames, health problems, and cheaper sources of cash. For this reason, many financial planners are still reluctant to advise their clients to obtain reverse mortgages.

In conclusion, there is reason to believe that demand for reverse mortgages will rebound, especially if the housing market recovers. On the other hand, earlier forecasts for an explosion in the market are unlikely to materialize, and the reverse mortgage will probably remain a niche product for the foreseeable future.

Have Feedback on This Article?