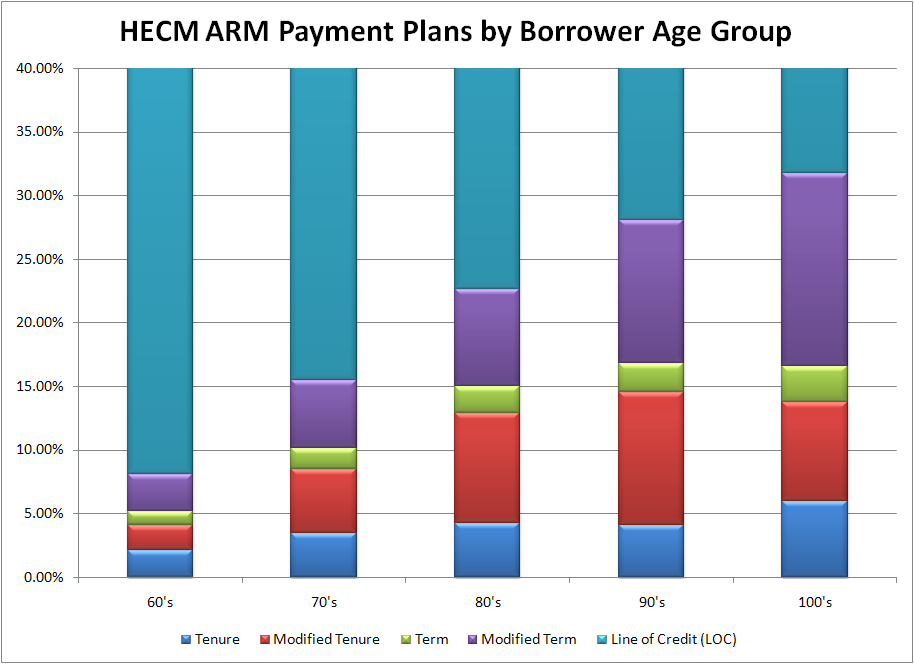

A picture is worth a thousand words, or in this case, a chart is worth a thousands words. Did you ever wonder how borrowers in your age group opt to receive their reverse mortgage payments? Below I’ve pasted a chart from Reverse Market Insight (a provider of analytics for the reverse mortgage industry) which provides a snapshot answer to this very question.

From this chart, you can clearly see how borrower preferences for payment plans vary by their age. Newly eligible borrowers overwhelmingly prefer to receive their proceeds as a Line of Credit (LOC). [It’s unfortunate that the data isn’t broken down along these lines, leaving us to speculate whether Lines of Credit are really Lines of Credit or whether they are actually lump-sump payments in disguise]. Older borrowers, in contrast, tend to select term/tenure payout plans. However, you can see that regardless of age, borrowers tend to take these in combination with Lines of Credit, rather than receive term/tenure payments in isolation.

For those of you who are scratching your heads, let me take a step back. When you obtain a reverse mortgage, you must decide how the loan will be paid out. If you elect to receive a Line of Credit, you can withdraw the balance of the loan in increments and at times of your choosing. You can take out all of the cash upfront as a lump-sum payment, or withdraw it in installments until the LOC is depleted. With tenure, you will receive a fixed monthly payment (determined by the lender based on actuarial assumptions) until you pass away. A term payout similarly refers to fixed monthly payments, for a duration or at a size of your choosing. With modified term or modified tenure, you will receive term or tenure payments, respectively, as well as a Line of Credit.

Back to the chart, it makes sense that youngish borrowers would prefer the Line of Credit payout option, because this is the most flexible. Many of these borrowers obtain reverse mortgages in order to pay off primary mortgages or for emergency purposes, in which case they would probably withdraw a majority of the loan balances upfront. Those that desire to simply maintain a high standard of living would also be best served by a Line of Credit, because it is conducive to withdrawing cash for discretionary purchases.

Homeowners in their 80s or 90s are both more financially conservative and in worse financial shape than their younger counterparts. Thus, these reverse mortgage borrowers usually select term/tenure payouts in order to pad their monthly incomes. Such borrowers are unlikely to obtain cash for emergency reasons and are even less likely to obtain loans to enhance their standard of living. Still, it’s interesting that these borrowers elect to set aside some cash in the form of a Line of Credit, which can be tapped in an emergency situation or drawn down gradually if the monthly payment was set too low.

While this chart is certainly useful for borrowers that are currently contemplating obtaining reverse mortgages, you should ultimately select a payment plan not based on what others are doing, but based on your own circumstances.

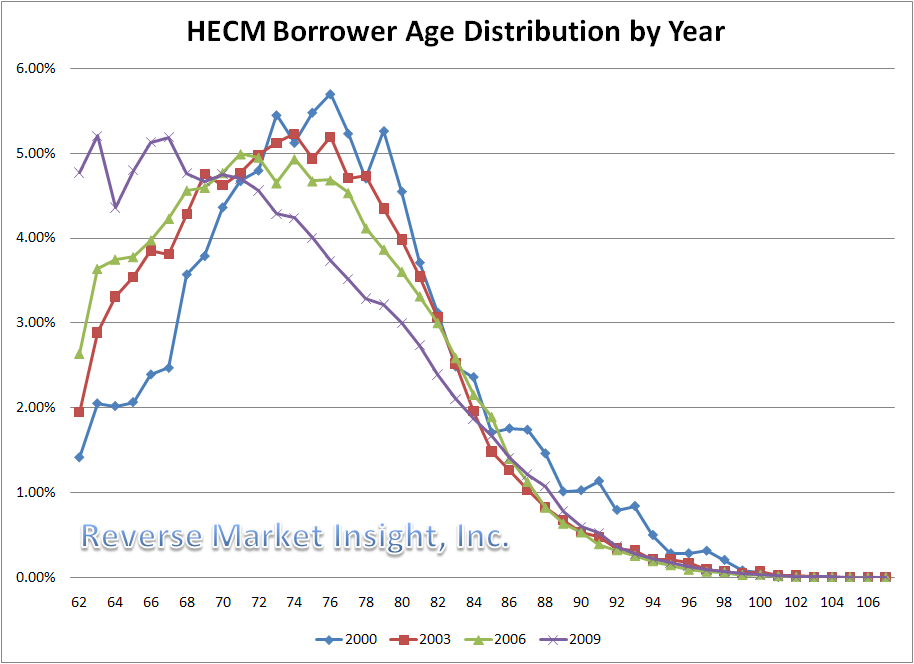

Well, not literally. But the age at which borrowers are obtaining reverse mortgages is steadily falling. According to the most recent industry data, the average age was only 72 in 2009, down from 77 in the year 2000.

This trend is on full display in the chart below, where you can see that the age distribution is gradually being pulled closer, such that the majority of borrowers now hail from the younger side of the eligibility spectrum rather than the midpoint This observation is reinforced by anecdotal evidence, as industry professionals have noticed more and more borrowers in their 60s and fewer in their 70s. Borrowers in their 80s and 90s now represent a smaller proportion of the total than at any point since records starting being kept.

There are a handful of possible explanations for this trend. The first is that relatively younger borrowers are perhaps more comfortable with debt than previous generations. The second is that baby boomers (the first batch of which became eligible for reverse mortgages in 2008) have “higher expectations of living standards.” From a financial point of view, it stands to reason that these borrowers are unprepared for retirement and lack adequate savings. This condition was probably exacerbated by the credit crisis and the subsequent economic recession, which devastated the portfolios of many baby boomers and sent them into early retirement.

While reverse mortgages were previously obtained by borrowers well into retirement, they are now being sought out by those who have only recently become eligible; 30% of borrowers in 2009 were 68 years or younger. It is interesting that such borrowers either don’t have the capacity to simply can’t bear to wait a few more years before obtaining loans. This phenomenon is especially incredible when you consider that borrowing limits are much lower for younger borrowers, who might be better served by waiting 5-10 years after becoming eligible before applying.

While the four lines on this chart show a trend moving entirely in one direction, it’s hard to imagine that it will continue in this way unabated. On the other hand, the explosion of retiring baby boomers should create a tremendous amount of demand among younger borrowers. In addition, the stock market probably won’t return to earlier levels for at least a decade and jobs (especially for the middle-aged) may remain scarce. It will be interesting to see whether this causes the distribution curve to steepen even further.

In the latest addition to my “HECM Versus…” series, I’d like to compare the reverse mortgage with the Home Equity Line of Credit (HELOC). For some borrowers, the dilemma is whether to obtain an HECM instead of a HELOC. For other borrowers, the dilemma is whether to use an HECM reverse mortgage to pay off an existing HELOC.

For those borrowers who are eligible for reverse mortgages (i.e. at least 62 years of age), the main appeal of selecting a reverse mortgage (instead of a HELOC) is that the reverse mortgage doesn’t need to be repaid in monthly installments. In fact, it only needs to be repaid when the last borrower passes away, and/or the property is no longer the borrowers’ primary residence. Only at that point (or if the borrower fails to pay property taxes, homeowners insurance, and/or fails to maintain the property) can the reverse mortgage be recalled, whereas a HELOC can be cancelled by the lender at any time. In addition, the proceeds from a reverse mortgage can be used for any purpose, whereas a HELOC might come with restrictions that govern the way the money can be spent.

The main disadvantage of a reverse mortgage is the price tag. Upfront costs include origination fees, a Service Fee Set Aside (SFSA), and a hefty FHA insurance premium. For every year that the reverse mortgage remains outstanding, it will continue to accrue interest, which will be added to the balance of the loan along with the annual insurance premium.

Otherwise, the two loans are structured similarly. For those that know that they want a line of credit, a HELOC and a reverse mortgage line of credit work the same way. You pay an origination fee for the right to use the line of credit, but with both loans, interest only accrues on money that is withdrawn. The interest rate on a HELOC is typically variable, whereas an HECM borrower can select a fixed rate or a variable rate.

For those borrowers that are trying to decide between a reverse mortgage and a HELOC, you should first ask yourself whether you will have the capacity to repay the loan. Since a HELOC can be obtained at a significantly lower cost, it is preferable to a reverse mortgage for those borrowers that are using the money for home-related improvements and have budgeted to repay the loan in a given time period. However, for those borrowers that are uncomfortable with a variable interest rate, the reverse mortgage might be the safer – albeit more expensive – choice.

The decision of using a reverse mortgage loan to repay a HELOC is more complicated. Obviously, it would have been ideal to have simply obtained a reverse mortgage in the first place, because under this scenario, you will ultimately pay two sets of origination fees. Anyway, if you misjudged your financial position and determine after-the-fact that you simply can’t repay the HELOC, the comparatively inexpensive solutions include borrowing money from family/friends, using your retirement account to repay the funds, or simply selling your home. If neither of these is realistic/desirable, a reverse mortgage could be your only way out.

Most borrowers realize that the greatest cost component of their HECM reverse mortgage are the FHA insurance premiums, paid both up-front and annually. Fewer understand the function of such insurance, why they are required to purchase it, and why the cost should be so significant.

The nature of reverse mortgages – that they carry no duration and that they don’t need to be repaid in monthly installments – leaves the lender vulnerable to the possibility of default. Consider what would happen if the value of the property were to fall and/or the balance of the loan were to rise, such that the reverse mortgage was characterized by negative equity (aka underwater). Under such conditions, the sale of the property alone would not be enough to repay the balance of the loan. Since reverse mortgages are no-recourse loans, the borrower cannot be held responsible for the difference.

Who absorbs this loss? You might be wondering. Ordinarily, it would be born by the lender. Due to the FHA insurance, however, it is in fact the government (HUD/FHA) that will be on the hook for the difference. In this way, the lender can originate reverse mortgages without any concern for what happens to the value of the property and the balance of the loan.

In return for this peace of mind, borrowers (not lenders, interestingly) must pay a hefty insurance premium upfront, usually equal to 2% of the value of the property. They must also fork over an additional .5% of the property value every year thereafter, for as long as the reverse mortgage remains outstanding. Of course, this premium isn’t paid directly, but rather is deducted from one’s home equity and tacked onto the balance of the loan.

The HECM reverse mortgage program (and the insurance component) is run as a not-for-profit service by the FHA. In theory, then, the size of the premium should correspond with the rate of default. Due to the housing crash, however, reverse mortgage defaults have surged, to the extent that the FHA barely has enough insurance reserves to cover its obligations to lenders. In hindsight, that means the FHA was effectively subsidizing borrowers, by enabling them to withdraw more than their homes were worth. As a result, the FHA is has already moved to raise insurance premiums and lower borrowing limits in order to bring its costs in line with the reality of the housing market.

Now you can understand why premiums are so large (and even why they are about to get even larger). Thanks to the insurance, you don’t have to worry about fluctuations in the value of your home, nor the possibility that you could owe more than your home is worth. While this is undoubtedly a great perk, you should nonetheless also be aware that while this cost is born by you, the main benefit is reaped by your lender, who assumes zero risk in lending you money.

Think about that when you are asked to hand over a check for the FHA insurance premium.

It might surprise you, given the bombardment of reverse mortgage advertisements and tales of unheralded growth, that reverse mortgage volume is actually down in 2010: “The volume of reverse mortgages is off nearly 40 percent so far this year, and is on an annual pace to record only 70,000 transactions nationally for the entire year. The number of lenders active in the reverse mortgage market has plunged by more than half in the past year to roughly 600, according to Reverse Mortgage Insight, which tracks industry trends.”

It’s difficult to ascertain what’s behind the decline. After all, lenders are fighting to outdo each other in cutting fees. Interest rates are near all-time lows. Decimated stock portfolios, high unemployment, and the beginning of retirement for the baby boom generation should spur at least modest growth in demand. What gives?

First of all, the decline in home prices means that it’s a comparatively unattractive time to take out a reverse mortgage. Those that missed (what was in hindsight) the boom may have decided that they will be better served waiting for a recovery. In addition, the FHA is cutting loan maximums in an effort to remain solvent, rendering an entire class of borrowers (those that wish to obtain a reverse mortgage to pay off an existing primary mortgage) ineligible. The FHA is also raising insurance premiums, which will completely offset any declines in interest rates. Speaking of low rates, such also makes it attractive to refinance a primary mortgage in lieu of obtaining a reverse mortgage.

Finally, it appears the reverse mortgage industry is still suffering from an image problem. A flurry of critical reports in 2010, namely from the National Consumer Law Center, Consumer Reports, US News & World Report, and even the Comptroller of the Currency, who famously compared reverse mortgages to subprime mortgages. Personally, I wonder if the pendulum hasn’t swung too far in the opposite direction – from complacent acceptance to paranoid rejection – and won’t at some point swing back.

In fact, July witnessed the first monthly increase in volume since 2009, which means that it’s possible that the market has hit bottom. If interest rates remain low and home prices recover, demographic trends would seem to engender an inevitable pickup in demand. Ultimately, 2010 was a dose of realism for the industry. For all the hype, reverse mortgages remain a niche product, and it will likely be many years before they are considered truly mainstream.

Anecdotal evidence suggests that many adult children remain vehemently opposed to their parents obtaining reverse mortgages. Due to a combination of confusion over the structure of the reverse mortgages and concerns that the mortgages will eat into their future inheritances, it appears many adult children are opting to instead support their parents directly. But is this the right choice?

From the standpoint of protecting one’s inheritance, it probably is. Due to a combination of fees, insurance premiums, and interest, reverse mortgages gradually erode home equity, such that a borrower who obtains the maximum loan amount may be left with little or no equity in under 20 years. Unless the price of the home appreciates proportionally over this period, there is a real likelihood that the heirs will receive nothing from the sale of the home after the loan is repaid.

Where there is consensus that the home should be bequeathed upon one’s death (rather than mortgaged and ultimately sold), a reverse mortgage probably isn’t suitable. Instead, adult children should consi der their a few alternatives. Specifically, they can support their parents directly (by writing them a check every month, for example), purchase the house outright from them, or loan money to them using a structure similar to a reverse mortgage. In situations where adult children can afford any of these possibilities, the benefit is that no profits are extracted by a third party (lender). Another advantage is that the adult child can help his parent(s) manage their finances, by controlling the flow of cash to them.

In situations where this is either not practical, not affordable, or just plain not desirable, a reverse mortgage can serve the same purpose. The benefit is increased flexibility and freedom (from the borrowers’ standpoint). The reverse mortgage also serves as a de facto insurance policy against home price depreciation, since any losses from such will be born proximally by the lender, and ultimately by the FHA, through which most reverse mortgages are insured. The drawbacks – which at this point are probably already clear to you – are the high costs of the mortgage and lack of control over your parents’ finances. In addition, if they exhaust the proceeds from the reverse mortgage (to guard against this possibility, you could encourage them to select the monthly payment option), you would still be in the position of supporting them.

Today, I want to address an aspect of obtaining a reverse mortgage that would seem to be simple, but can actually be quite complex: listing the borrower(s).

Consider that with a conventional mortgage, adding additional borrowers to the loan contract can change the terms, either for better or worse. For example, it could support a higher loan amount (since the lender will factor in the income and assets of the second borrower), but could also lead to a lower interest rate (if the second borrower has extraordinarily bad credit).

With a reverse mortgage, the issue is that the lender will use the age of the youngest borrower when determining the loan amount. [Recall that maximum loan amounts are dictated by the FHA, based on age, home value, and interest rates. All else being equal, the older one is, the more he is entitled to borrow]. Thus, if you are 75 years old and your wife is 62, why not just leave your wife off the loan documents? This way, you can drastically increase the amount that you can borrow, right?

While this is indeed true, consider that doing so will put your spouse in jeopardy. When the last remaining borrower passes away or moves out, the loan will become due. If there is only one borrower listed on the loan, then the loan will naturally become due when that borrower dies, regardless of whether he is survived by a spouse. On the other hand, if the younger spouse is listed as a co-borrower, you will receive less money, but at least the loan will remain outstanding even if one of you passes away.

Another issue: what if the younger spouse is under 62? In this case, you will not be able to obtain a reverse mortgage, even if you were to leave the spouse’s name off of the mortgage. The only solution would be to remove the spouse’s name from the title of the property. Again, consider the ramifications: if you were to pass away, not only would the spouse be forced to vacate the property, but also would lack any legal claim to the property pending the adjudication of your estate.

If you still decide to initially leave the younger spouse (whether under of over the age of 62) off of the loan, bear in mind that you will have to refinance the loan in order to have him/her added. This also holds true for a situation of divorce and/or remarriage. If you are in urgent need of cash, the risk might be justified. Otherwise, it’s probably best to hold off on obtaining a reverse mortgage until all owners of the property (i.e. both spouses) are prepared to be listed as borrowers.

I have seen numerous articles (some of them from my own pen!) with a strongly negative slant towards reverse mortgages, and perhaps an equal number that do nothing but extol their virtues. What I haven’t seen – and would henceforth like to offer here – is a feature that combines both the pros and cons, such that potential borrowers can clearly see the real calculus that underlies the decision to obtain a reverse mortgage.

Lets start with the benefits. First of all, the flow of funds under a reverse mortgage is one-way. In other words, you don’t have to write any checks to your lender. All of the money associated with the origination of the mortgage flows in your direction. This will be an especially welcome development if you obtain a reverse mortgage in order to repay an existing primary mortgage. Of course, you are merely swapping one kind of debt for another, it’s nice to no longer be responsible for making payments to your lender.

In addition, you have a tremendous amount of flexibility in how you receive and use these funds. You can opt to receive a lump-sump payout, monthly check, or a line-of-credit. You can spend the proceeds on anything you want, however, frivolous, and no one will have any legal basis for intervening.

Second, reverse mortgages allow you to continue to live in your home until you pass away, move out, or fail to maintain and pay taxes on the property. Unless one of these conditions is breached, you can happily remain in your home until the day you die. Regardless of any changes in the property value and the balance of your reverse mortgage, the home will remain yours until the lender is justified in calling the mortgage.

In some sense, then, the reverse mortgage represents a bona fide opportunity to have your cake it and eat it too. As long as you honor the terms of your loan, you can tap the equity of your home for any purpose, all the while still enjoying the right to continue to live there, undisturbed.

Of course, any honest sales pitch should also give space to the drawbacks of a reverse mortgage. Namely, they are expensive. To be fair, the FHA (the government agency which insures 95% of all reverse mortgages) strictly regulates these fees, and lenders themselves have been proactive in reducing them when possible. Still, when you consider the reverse mortgage insurance premiums, origination fees, and service-fee-set-aside (SFSA), reverse mortgages are generally more expensive than conventional mortgages. And don’t forget the biggest cost: interest. Because reverse mortgages are negatively amortizing, the interest will continue to accrue (and compound!) until the loan is repaid.

In addition, reverse mortgages have the potential to be abused and obtained for inappropriate reasons. Since it is no one’s responsibility to police how the reverse mortgage funds are used, anecdotal evidence (and human nature) suggests that funds may be spent on frivolous items, such as vacations, new cars, etc. Reverse mortgages were originally conceived to help older borrower repay primary mortgages and tap their home equity to improve their residences. Those who use the funds for other purposes do so at their own financial peril.

The final drawback is that while ‘special,’ a reverse mortgage is still a mortgage. What that means is that if you breach the terms of the contract, the lender can and will foreclose on the property. For example, if the borrower dies or moves out, the lender will recall the loan. Any surviving spouse or family member will not be permitted to continue to reside in the home, unless one of them was also listed as a borrower when the loan was obtained. Also, if the borrower fails to pay property taxes and insurance, and fails to adequately maintain the property, the lender will be justified in recalling the loan.

In short, the reverse mortgage is not a free lunch. You can tap the equity in your home while continuing to live there, but you do so at a price. Understand that trade off, and make your decision accordingly.

The gradual decline of borrowing rates has not only affected conventional mortgages; reverse mortgages, too, have benefited from the trend.

According to Freddie Mac, the average rate for a conventional mortgage is now less than 4.5%. While comparable figures for reverse mortgages are not currently available, many of the largest lenders are now offering HECM fixed-rate reverse mortgages at 5%. [The difference can mainly be accounted for in the .7 points that the average conventional mortgage borrower pays to the lender in exchange for the lowest rate possible].

Variable rates, meanwhile, are also hovering around record lows, and a variable-rate HECM reverse mortgage can now be had for around 3.5%. In spite of this, most borrowers these days are opting for fixed-rate mortgages, perhaps as a hedge against higher rates. [For an in-depth comparison of fixed versus variable rate mortgages, you can read an earlier post: Reverse Mortgages: Selecting an Interest Rate] Even though there is currently a 150 basis point spread between variable and fixed rate reverse mortgages, there is a risk that variable rates could rise, in which case those that had locked in a fixed-rate (reverse) mortgage would come out ahead over the long-term.

Of course, it’s not clear how long rates will remain at current, low levels. Fixed rates for reverse mortgages have been around 5% for most of the last year, and theoretically, they could begin rising at any moment. In fact, analysts predicted that rates would rise in 2010 thanks to the unwinding of the Fed’s program of buying Mortgage-Backed Securities. Due to lingering concerns of economic recession and deflation, however, their predictions have been stymied and rates have continued to slide.

For those who are trying to time the market, consider that interest rates, home valuations, and your age are the three main factors that determine the amount of money you will receive from your reverse mortgage. Thus, if you take advantage of low rates and obtain a reverse mortgage now, you might be negatively impacted from a low home valuation. On the other hand, if home prices rise, any gains may be offset by rising interest rates.

Ultimately, it’s difficult to “beat the system,” and I would advise you to avoid getting caught up in interest rate and home valuation fluctuations, and instead to obtain a reverse mortgage only when it suits your circumstances. If you guess wrong, you can always refinance.

The FHA is currently mulling a new reverse mortgage product, which has been nicknamed by industry insiders as HECM Lite.

For all intents and purposes, the HECM Lite will be identical to the existing Home Equity Conversion Mortgage (HECM), with two key differences. First, the maximum borrowing amount would be significantly smaller compared to the HECM. Second, there would be no upfront mortgage insurance premium, but only an annual premium of perhaps 1.25%. In a nutshell, there would be less money distributed to borrowers and less risk for the lender.

The product is being compared to a home equity loan, in that it will probably appeal to those with small or nonexistent primary mortgage balances and who wish to only tap a small portion of their home equity. In fact, the only discernible difference between between the two is that a home equity loan amortizes normally, while a reverse mortgage (HECM Lite in this case) is negatively amortizing, and carries no duration. In practice, borrowers might also find that the HECM lite is more reliable than a Home Equity Line of Credit, which can be cut by the lender without warning at any time.

As I alluded to in the title of this post, it is expected that the HECM Lite will fulfill two ends. First, it should help to alleviate the financial problems of the FHA. Due to declining home values, high borrowing amounts, and (in hindsight) inadequate insurance premiums, the reverse mortgage program is currently underwater. It is anticipated that by reducing borrowing amounts while maintaining the annual insurance premium will result in lower risk and stable profits for the HECM program, so that it continue to sustain itself without the need for a government cash infusion.

Second, it is hoped that the HECM Lite will appeal to a class of borrowers for whom the existing HECM is unattractive. As FHA insurance premiums rise, criticism will once again mount that the HECM is uneconomical for many, if not most borrowers. As a result of this new product, however, those who wish to borrow comparatively modest amounts and are consequently unlikely to default, will be able to do so at a comparatively reasonable cost.

Ultimately, the HECM Lite is still in the gestation phase, and its not clear when, or even if it will be introduced (though a tentative roll-out date of October 10 has been put forward) . Also, the fact that there is no upfront insurance premium might make it less attractive for lenders, which might try to compensate by raising the origination fees. Still, there is consensus that the HECM lite is a step in the right direction, both in increasing consumer choice and in alleviating the FHA’s fiscal problems.