Those of you who regularly read this blog are probably surprised to see such a title. After all, this blog purports to be an advocate for consumers (i.e. potential borrowers), rather than lenders. As a result, many of my posts are mildly critical of reverse mortgages. In the end, however, I like to think of myself as an unbiased quasi-journalist., and I simply call it like I see it.

On that note, I think concerns over reverse mortgage fraud are overblown. With the recent release of the FBI’s annual Mortgage Fraud Report, analysts are attacking reverse mortgages with renewed vigor, and simply rallying around fraud as an obvious focal point.

To be sure, mortgage fraud is real and it is abhorrent. According to the report:

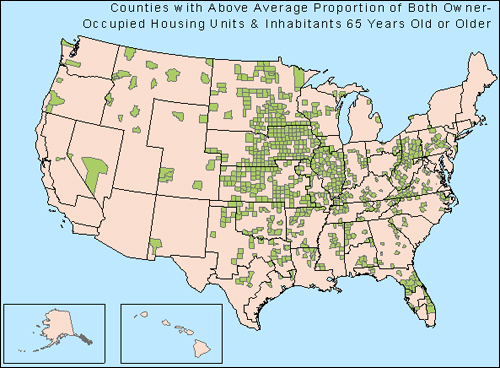

Perpetrators recruit seniors through local churches, investment seminars, and television, radio, billboard, and mailer advertisements and commit the fraud primarily through equity theft, foreclosure rescue, and investment schemes. HECM-related fraud is occurring in every region of the United States, and reverse mortgage schemes have the potential to increase substantially as demand for these products rises in demographically dense senior citizen jurisdictions.

It is frequently pointed out that due both to the demographics of borrowers and the very nature of the product, fraud is especially rife in reverse mortgage lending. There is certainly some truth to this, as it has been established that seniors are comparatively susceptible to being deceived and are less likely to report such deception. In addition, since reverse mortgages don’t require one to spend any money (all fees are rolled in), borrowers are perhaps more apt to let their guard down, since upon closing, they will still finish with money in their respective pockets.

At the same time, however, fraud is a risk in all manner of commercial transactions, and reverse mortgage are hardly unique in this regard. I’m not apologizing for reverse mortgage fraud; on the contrary, I denounce it and think that borrowers should be vigilant in preventing it, and law enforcement agencies should be strict in prosecuting it. At the same time, there is no indication that fraud is any more prevalent (the FBI’s report doesn’t offer any figures) among reverse mortgages than it is in conventional mortgages.

To illustrate this point further, I recently came across two articles that purported to blow the whistle on reverse mortgage fraud. Upon closer inspection, however, it appears that the first (“Mortgage Fraud: A Classic Crime’s Latest Twist“) article was actually a case of title fraud, while the second (“New Scam Targets Elderly Homeowners with Reverse Mortgages“) profiled a new scam that is neither explicitly fraudulent nor explicitly connected with reverse mortgages. In short, naysayers are basically firing blanks in their collective quest to unearth widespread reverse mortgage fraud.

From the standpoint of borrowers, reverse mortgage fraud is not necessarily easy to identify, but it is pretty easy to avoid. As a general rule, you should avoid solicitations. If you decide, against your better judgment, to respond to a solicitation, make sure that the lender is licensed to make reverse mortgage loans in your state. If you are starting from scratch, you can browse our directory and/or or locate a lender through the National Reverse Mortgage Loan Association (NRMLA), which vouches that all of its members are “licensed to originate reverse mortgages in the states in which they are listed and have signed NRMLA’s Code of Conduct.” Finally, remember that before singing a reverse mortgage loan agreement, you are not only entitled to, but are required to undergo a government-sanctioned counseling session. If your loan has any hint of being a scam, it should be exposed at this stage.

For those of you with primary mortgages, you are probably already familiar with the idea of an Acceleration Clause. For reverse mortgage borrowers, however, the inclusion of such a clause in your loan contract might come as something of a surprise.

In a nutshell, an acceleration clause is just as it sounds: it is a clause that stipulates conditions under which the repayment of your mortgage will be accelerated. If certain terms are breached, in other words, you might suddenly be required to repay your mortgage. Forget about the number of years left until your loan matures- the entire balance is now due in full, payable to the lender.

Reverse mortgages are special, in that they don’t usually have specific time durations. Therefore, the acceleration clause serves a very important function, since without it, the loan would never mature! The specific conditions that would trigger repayment are typically as follows: death of the last remaining borrower, vacating of the residence by the last remaining borrower, failure to maintain the property, and/or failure to pay homeowners insurance premiums and property taxes.

Once any of these conditions is reached, the loan immediately comes due. In fact, the FHA is now putting more pressure on lenders to be more aggressive on enforcing acceleration clauses for borrowers that fall into the latter category. As for the passing away or moving out of the borrower, lenders are slightly more lenient. To be sure, upon such a an event, the loan immediately becomes due. As I explained in an earlier post, however, the borrowers’ heirs can petition for a 1-year extension in order to plan for the sale of the property and/or repayment of the loan.

In short, don’t panic when you read the acceleration clause in your reverse mortgage contract. They are a standard part of the process, and certainly not a scam. Of course, you should still scrutinize the clause in order to make sure that it doesn’t contain any conditions beyond those that I listed above. Since all lenders that participate in the HECM reverse mortgage program are subject to FHA oversight, however, it seems unlikely that they would attempt anything deceptive.

Most importantly, make sure you fully understand the clause. It should be obvious that the loan becomes due when the primary borrower dies. What is less obvious, though, is that the lender can force repayment if the borrower moves out, and/or stops maintaining the property and paying taxes/insurance. Before signing the contract, then, it’s vital that you understand this.

As a result of the dual housing and economic crises, reverse mortgages are being marketed to seniors with renewed vigor. For those that have fallen behind on their mortgage but would like to remain in their respective homes, goes the sales pitch, Why not obtain a reverse mortgage and avoid default? For those whose mortgages are already paid off, goes another pitch, Why not obtain a reverse mortgage for the benefit of having extra cash?

Let’s examine both of these pitches in greater detail. First of all, the idea of using a reverse mortgage to pay off an existing mortgage is nothing new, and was conceived well before the inception of the housing crisis. However, given that more and more borrowers are having trouble staying currency on their primary mortgages, the idea of eliminating one’s mortgage is now more appealing than ever.

To be sure, this is a perfectly valid use for a reverse mortgage. Prospective borrowers need to bear in mind, however, that the majority of the proceeds will be used to pay off their primary mortgages and there will probably be little, if any funds leftover for discretionary spending. Borrowers availing themselves of reverse mortgages for this purpose, then, should make sure that they have adequate savings to support themselves.

The second pitch – using a reverse mortgage to support oneself (temporarily) because of economic hardship – is also justifiable, but also carries certain risks. This idea will probably appeal to prospective borrowers that are “house rich, cash poor.” These borrowers probably have very little primary mortgage debt but otherwise have marginal financial positions. For them, the reverse mortgage represents a source of income and a way to pad one’s savings account.

The risk of such a strategy is that one’s financial position will never improve, in which case the borrower will find himself in the unenviable position of depending entirely on a reverse mortgage for financial support. Once all of the proceeds are spent, the borrower will have to sell the home anyway. Unfortunately, by the time that point comes, much of the borrower’s home equity will probably have been depleted.

In short, reverse mortgages can provide invaluable support to those facing economic hardship. Just make sure that you understand the risks, and that you plan for life after the reverse mortgage.

Today, we bring you an interview with the blogging team from Reverse Mortgage Adviser. Below, they share their thoughts on the benefits and drawbacks of reverse mortgages, as well as handful of specific issues that (potential) borrowers should be aware of. [Such represents the opinions of Reverse Mortgage Advisor staff and is not intended to serve as official advice].

In the beginning of June, Generation Mortgage Company re-introduced its proprietary (i.e. not FHA-insured) reverse mortgage product, geared towards homes too expensive to qualify for HECM reverse mortgages. The news has been getting attention, and while I hate to give Generation (more) free publicity, in this case, the attention is warranted.

Since the collapse of the housing market, all national lenders abandoned their proprietary reverse mortgage product lines because the risks (of home decline and loan default) were suddenly too great to justify offering them. The FHA quickly – though somewhat unwittingly – filled the resulting void with ts HECM reverse mortgage, which has since come to represent more than 95% of new reverse mortgage originations.

In response to soaring losses, however, the FHA has begun to clamp down on lenders (by pressuring them to foreclose when justified) and borrowers (by raising insurance premiums and lowering maximum loan amounts). Thus, it would seem that there is now once again for a competitive proprietary product.

Enter Generation Mortgage Company. Its jumbo proprietary reverse mortgage can be used for homes valued between $500,000 and $6 million. Since the loan is not insured by the FHA, borrowers can expect to pay a higher interest rate to compensate the lender for the added risk. Still, even the FTC concedes that this might be the best option for those with expensive homes: “HECMs generally provide bigger loan advances at a lower total cost compared with proprietary loans. But if you own a higher-valued home, you may get a bigger loan advance from a proprietary reverse mortgage.”

It’s hard to say whether this will be the start of a new trend towards proprietary reverse mortgage lending, since for those with moderately priced homes, it seems the FHA HECM is still the most economical choice. However, if other lenders witness strong demand for Generation’s new mortgage and that Generation itself is able to turn a profit, it could lead to a spate of new proprietary reverse mortgage offerings.

When the last remaining borrower dies, the reverse mortgage becomes due, right? Actually, it’s slightly more complicated.

Since most lenders will periodically check on the status of the borrower(s), they will probably learn of the death shortly after it happens. At this point, a letter will me mailed to the primary beneficiary/heir (designated by the borrower and confirmed in the will) apprising one of the situation.

Specifically, you have a few options:

1) Repay the loan in full and keep the property.

2) Sell the property and use the proceeds to repay the loan.

3) Deed the property back to the lender/investor.

4) Abandon the property.

Those who choose to sell the property should be aware that they must receive at least 95% of the appraised value or the full value of the outstanding loan. That rules out the possibility of selling the property to a friend/relative for less than the value of the loan (which is barred by HUD anyway) and simply pass along the loss to the FHA, which presumably insured the reverse mortgage.

If you intend to repay the loan directly and/or sell the property, you should be aware that you technically have 12 months to do so. Unless the property is deeded back to the lender or it has been foreclosed upon, the property officially belongs to the heirs, who retain the right to continue living in the property. As long as they are making a reasonable effort to sell the property or obtain alternative financing to repay the reverse mortgage, the lender will likely grant them a maximum of 4 extensions of three months apiece. During this time, taxes/insurance premiums must continue to be paid, and the loan will continue to accrue interest. If after 12 months no progress has been made or if the heirs violate the terms of the contract in some other way, you can expect the lender to initiate foreclosure proceedings.

Regardless of what happens, you should be aware that you are entitled to any leftover equity in the property if the sale price is greater than the loan balance. On the flip side, a reverse mortgage is a non-recourse loan (and insured by the FHA), which means if it is underwater, the heirs are not liable. If worse comes to worst, you can simply abandon the property and walk away.

I apologize for frightening you with the title of this post, but there’s no way to sugarcoat it; in a desperate attempt to shore up its finances, the FHA – which insures 95% of reverse mortgages – is authorizing reverse mortgage lenders to go ahead and foreclose on properties that warrant it.

The initiative is designed to target borrowers that aren’t paying property taxes and/or hazard insurance premiums, as well as those that aren’t properly maintaining their properties. Given the terms of FHA HECM reverse mortgages, it is only such borrowers who will be affected. That means that the vast majority of borrowers will be unaffected by this push and can rest assured.

It should be noted that not paying property taxes and homeowners insurance premiums has always constituted a violation of the reverse mortgage contract and thus is grounds for foreclosure. In practice, however, the FHA “Didn’t want bad headlines” and didn’t pressure lenders to foreclose.

That was the case when the solvency of the program was a given. Last year, it lost $800 million, and the FHA is struggling to close that gap. The issue is that those who don’t pay their property taxes could ultimately be subject to government tax liens, which would receive repayment priority over the reverse mortgage. With regard to not paying insurance premiums, the concern is that a flood, fire, or other disaster could destroy the collateral (aka the property) for the reverse mortgage. The same risk applies to properties that aren’t adequately maintained.

Apparently, cases of “technical default” or on the rise, due in no small part to the economic recession. In addition, the lack of a built-in escrow account for taxes, insurance premiums (distinct from the HECM insurance), and projected maintenance costs means the onus for monitoring such requisite expenditures is entirely on the borrower.

In short, for those with reverse mortgages understanding, as well as for those contemplating obtaining one, make sure that you honor the terms of your contract. The consequences of not doing so are now serious, and potentially devastating.

I’ve seen dozens of solicitations and information sheets that contain a full litany of situations in which reverse mortgages are suitable for potential borrowers. What I have yet to see, however, is a comparable list of situations in which reverse mortgages are definitely not appropriate. Here goes:

- Short-term Time Horizon: Due to high upfront costs (origination fees, insurance premium, etc.), a reverse mortgage is simply not economical over a short time horizon. In order for it to be worthwhile, you should plan on staying in your property for a minimum of 7 years. If your time horizon is shorter, you should consider an alternative source of financing.

- Strong Financial Position: If your financial position is currently strong, there’s no reason to obtain a reverse mortgage, since you will pay annual fees, interest, and insurance premiums for as long as the loan is outstanding. Instead, wait until your cash position deteriorates (ideally, this will never happen), and/or you have a legitimate financial need before contemplating a reverse mortgage.

- Young Age: If you are barely older than 62 (the age at which one becomes eligible for a reverse mortgage), you might want to consider waiting a few years before obtaining a reverse mortgage. I offer this suggestion not only because FHA loan maximums are correlated with age, but also because the longer your loan remains outstanding (the more interest it will accumulate). Therefore, by waiting, you can both obtain a larger loan and save money (on interest) over the life of the loan.

- Desire to Live Affluently: If your primary motivation for obtaining a reverse mortgage is to raise your standard of living, please reconsider. While trading home equity for a nice vacation, new car, and a few fancy meals might seem like a good idea, you will almost certainly regret your decision when the time comes that you have a genuine need for some extra money.

- Property Needs Repairs: If your property is in poor condition, you need to bear in mind that under the terms of the reverse mortgage, it is your responsibility to fix it. Failure to do so could lead to foreclosure. If only minor repairs are necessary, however, you can use the proceeds from an HECM reverse mortgage or better yet, a single-purpose reverse mortgage, to finance the repairs.

- Desire to Will Property to Heirs: If you have any desire to will your home to your heirs, a reverse mortgage is not appropriate, because when the loan comes due, the property will be sold. While your heirs still have the option of repaying the loan with cash at that time, a better choice would be for your heirs to purchase the home from you now or lend you money directly, so that there is no uncertainty when you pass away and/or the hypothetical reverse mortgage comes due.

- Poor Health: If your health is (excessively) poor, a reverse mortgage probably isn’t a good idea. Consider that even if you use the proceeds for legitimate medical expenses and your health worsens, you will be back where you started. Unless you need cash to pay for a one-time (i.e. not chronic) medical outlay, you should consider borrowing money from family members and/or selling your home.

- Lack of Savvy: Finally, if you don’t understand how a reverse mortgage works, do yourself a favor and take the steps to understand it, instead of diving right in. You might discover something that you don’t like that convinces you to reconsider. Then again, you might discover that in fact, it is suitable for you. The point is clear: educate yourself before making such a big decision.